Emerging CPG brands often fail to secure retail placement because they focus on pitching their product rather than demonstrating how it contributes to the retailer’s category growth. Retailers prioritize products that increase basket size, drive traffic, and differentiate their assortment. To succeed, brands must align with retailer strategies, understand shopper behavior, and showcase how their product solves a specific need and drives profitable category growth.

To successfully pitch a brand to retailers, focus on selling category growth rather than the product itself. This involves understanding the retailer’s persona and strategy, using data effectively, and demonstrating how the brand can help the retailer achieve their objectives. By positioning the brand as a strategic partner, rather than just a vendor, and providing unexpected insights and merchandising solutions, small brands can compete with larger ones and secure shelf space.

Listen where you get your podcast

The Retailers Won’t Tell You This, But I Will THE STORY — The First Time I Realized Why Retailers Say “No” WHY THIS MATTERS ⭐ STRATEGY #1: RETAILERS BUY CATEGORY GROWTH — NOT PRODUCTS ⭐ STRATEGY #2: PERFECT YOUR “RECOMMENDED PLACEMENT” ARGUMENT ⭐ STRATEGY #3: MASTER THE RETAIL PERSONA ⭐ STRATEGY #4: USE DATA LIKE A CATEGORY LEADER ⭐ STRATEGY #5: BUILD PARTNERSHIPS, NOT PRESENTATIONS 🔁 RECAP: 5 WAYS TO LAND SHELF SPACE & WIN AT RETAIL 🎧 In CLOSING

Enter your name and email address below and I'll send you periodic brand building advice, tips and strategies.

If you’re an emerging CPG brand, chances are you’re feeling two things the moment retail expansion enters the conversation:

you’re excited about landing more doors, and

you’re terrified you’ll blow the opportunity before you even get on the shelf.

And that fear is real — because most brands do blow it.

Not because they lack a great product.

Not because their mission isn’t compelling.

and Not because their story isn’t meaningful.

But because the entire industry has trained founders to believe that landing shelf space is about:

sending samples,

Having a check ready for the slotting and other retailer fees

having a pretty sell sheet complete with customer testimonials, graphs, and data,

showing up at the appointment with a multipage pitch deck,

and hoping a buyer says yes.

That’s not how it works.

In reality, retailers don’t buy products — they buy confidence.

Confidence that you understand:

The retailers go-to-market strategy

Their competitive landscape so that you can help them grow market share

their shoppers,

the category,

the trends shaping category growth,

where your product belongs,

and how you’ll help them win.

Landing shelf space is not a pitch.

It’s a partnership.

Today, I’m going to show you how to land shelf space and win at retail using a strategic, founder-led approach almost no small brand ever uses. This alone will give you a competitive advantage.

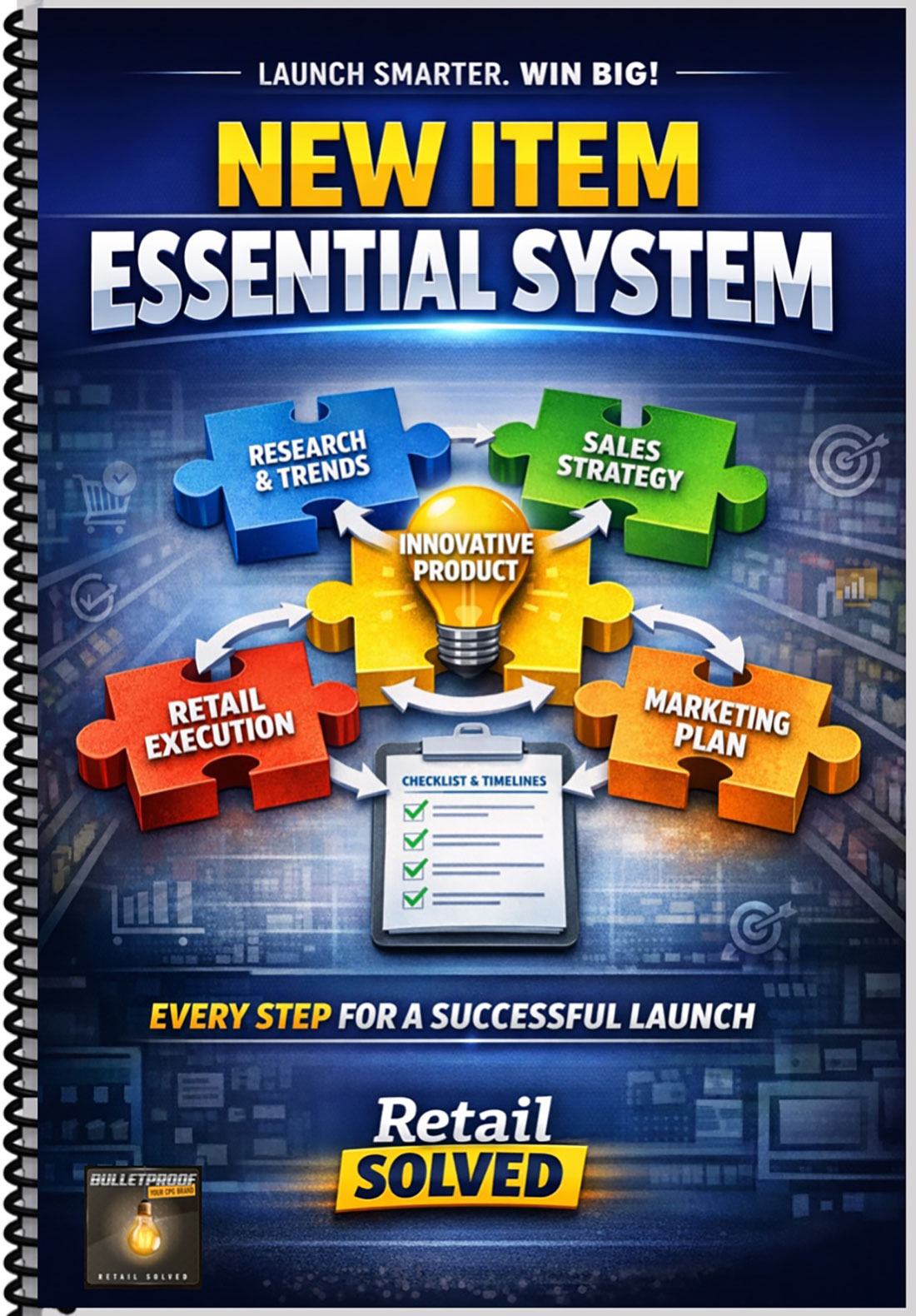

And I’ll be pulling from the New Item Essentials system, starting with one of the most important mini-courses inside it:

How To Land Shelf Space & Win at Retail.

This is a foundational skill big brands groom into their teams, and one that smaller brands must master if they want their new item launches to succeed.

This is also one of the most asked question founders routinely submit to my articles, podcasts, YouTube videos and emails.

But before we dive into the strategies, let me take you back to a real moment in my journey — a lesson that shaped how I approach retail to this day.

Years ago, when I was consulting with a fast-growing natural brand, we had a meeting with a major retailer for a key category review.

The founder was excited. They had been having a lot of success.

The product was strong and it was a good fit for the retailer.

The mission was inspiring and it aligned with the retailer.

Velocity was promising.

On paper, it looked like a slam dunk.

But as the founder delivered his presentation, I could see the buyer’s expression shift — from curious… to confused… to disengaged.

At the end of the meeting, the buyer said:

“I like your product, but I’m not convinced you know how it fits into our store.”

That was it.

No placement.

No test.

No second chance.

On the drive back, the founder asked me what happened.

Here’s what I told him — the same truth I’m going to share with you today:

“You told your brand’s story.

You didn’t tell the category’s story.”

That’s the moment founders lose the sale.

Because retailers aren’t looking for your mission first or why you think its a good fit for them.

They’re looking for how your product grows their category, attracts their core shopper, and differentiates them from their competition.

And the founder had never been taught how to do that.

This is why I created the New Item Essentials system — so brands can show up prepared, confident, and strategically aligned with what retailers actually need.

This is also why podcast Episode 54 struck such a chord — because misplacement, misunderstanding, and misalignment cost brands tens of thousands of dollars after they get on the shelf.

But the truth is, many brands never even get to that point because their initial presentation never speaks the retailer’s language. Go back and listen to that episode to gain Insider Secrets To Getting On Shelf with Retailers, Mathis Martines, Formerly with Kroger

Today’s episode fixes that.

Landing shelf space isn’t luck.

It’s a system.

You increase your odds dramatically when you understand:

retailer objectives and their go-to-market strategy

The retailers competitors and what gaps you can help them close

The category dynamics - how all of the products in the category interact

shopping behavior - how shoppers purchase the category - how they make buying decisions

The shoppers need state. Think of a need state as the problem they are trying to solve. For example, if they want to cook an Italian dinner for two they might want pasta, tomato basil sauce, parmesan cheese, bread, wine, and everything else that will make their meal memorable. What “problem” does your product solve and how does your customer shop your products. This is the kind of information retailer need from you. This is the kind of information they can’t get on their own. Sharing this will differentiate your brand.

So, where does your product fit

how your product transforms the shopper experience. For example, plant based shoppers typically purchase other plant based items across other categories.

and how you can help retailers achieve more shoppers and more profit. this is where you highlight your market basket and how you plan to drive shoppers into their store. For example, When shoppers purchase your product, they also purchase x, y, and z. Therefor their market basket is 12% higher than the average market basket for other items in the category when they purchase your products.

This episode is the first pillar in the New Item Essentials series, which includes fundamental:

Category Review Strategies

Assessing Brand Health - hint: it’s not velocity but rather your brands contribution

Shelf Strategies

Assortment Strategies

Merchandising

Market Basket Growth

Data Analysis

Broker Effectiveness

Category Management strategies

And today, we’re covering the step that determines whether you even get a shot:

👉 How to land shelf space and win at retail through advanced category management thinking.

Let’s dive into the three strategies that will transform how you approach new item placement.

The Founder Mistake

Most founders walk into retail meetings believing the retailer is evaluating their brand.

They’re not.

Retailers are evaluating the category, and whether your product will:

grow basket size- meaning cause shoppers to spend more at the register

trade shoppers up - meaning cause shoppers to spend more per transaction

drive traffic - meaning bring new shoppers into the category

differentiate their assortment - meaning providing something unique in their market

and deliver profitable contribution and velocity.

The ranking report trap — most retailers place too much importance on the ranking report but that does not tell the whole store. As I shared in episode 269, big brands tend to drive velocity through deep discounts effectively commoditizing their products and the category providing no real incentive to the retailers shoppers to be loyal when their prices return to normal. Despite this, their products tend to rank high on traditional category ranking reports.

This is why ranking reports are incomplete. They don’t tell the full story.

The real metric they need to consider is, Dollars per point of distribution. This is your brands contribution. This is also what the retailer takes to the bank. I dig into this more and why it matters in the Assessing Brand Health Mini Course.

The Better Way is

You must show:

how your brand aligns with retailer strategy

why your product matters to their shopper

what problem it solves - back their their need state

how it grows the category more profitably than mainstream alternatives - the big brands

To do this Use fact based insights like:

Shopper behavior. Better for you shoppers are less price sensitive and they will choose premium for products that align with their needs like less sugar, high protein, plant based, etc.

clean-label trends are at the center of the healthy eating. Shoppers want simple easy to pronounce ingredients that can be easily found in nature that are pesticide and chemical free

food-as-medicine patterns are a key trend that drives a lot of shopper buying decisions.

market basket expansion. Shoppers who buy your brand buy other premium products while in their store thus your market basket is higher than other brands in the category.

Action Steps todo This Week

Identify the top 2–3 attributes your ideal shopper values most. Have a conversation with them. They will tell you in their words why they choose your brand. Use their quotes in your retailer sales decks.

Map out how those attributes drive incremental category dollars. Use facts to validate your claims.

Prepare one slide that says:

“Here’s how we help YOU win your shopper.”

To dig deeper into this, listen to podcast episodes 104, 202, 176 to help you better understand their category mechanics.

The Founder Mistake

They pitch their brand without specifying where it belongs on the retailers shelf.

Or worse — they say:

“We’re flexible.”

No.

Flexibility is not strategy.

Your shoppers don’t want to go on a scavenger hut to find your brand.

From The Retailer Lens

Retailers aren’t experts in every category.

They rely on:

Others to manage their category schematics

Those time crunched resources typically manage schematics across multiple categories. Your brand is NOT their priority.

The third party companies don’t produce high quality results in most cases - speaking from personal experience. Some of the sets I’ve seen are a complete train wreck.

internal analysts - sometimes their numbers overlook key metrics like your contribution and how your brand interacts with other items in the category

broker assumptions including brokers that might manage competing products

incomplete planograms with incorrect product dimensions and configurations.

Your job is to show them where the shopper expects to find your product and why.

The Better Way

Is to Show:

a photo of your competitive set

Provide your recommended schematic - there is a creative recommendation included in the New Item Essentials guide available at the end of this episode

a brief fact based explanation of how the shopper shops their category

If this sounds familiar, it’s because Episode 104 proved how disastrous misplacement is.

Action Steps todo This this Week

Take photos of the exact shelf where your item belongs.

Annotate it with:

Where your product belongs and why

Show where the shopper expects to find your items, with fact-based reasoning

Tie your product placement to how your core customer shops the store (e.g., “When she buys X, she also looks for Y”)

Add a slide titled:

“Here’s where we belong — and why it helps your shopper win.”

Retailers don’t all want the same things.

Whole Foods wants innovation + premium shopper alignment.

Kroger wants mass adoption + category expansion.

Sprouts wants attribute + first differentiation.

Costco wants efficiency + trade-up value.

Target wants lifestyle alignment.

The Founder Mistake

Is Pitching the same story to every retailer.

The Better Way is to

Customize your pitch to match the retailer’s persona:

Most brands constantly make demands from retailers. How do I know this? I’ve held several senior retail management positions including grocery management at Price Club (now Costco). Few if any brands spoke to me as person not realizing that I held the fait of their brand in my hands. This was back when I had almost complete autonomy over my department.

When I worked for Unilever we called this account penetration. We were required to compose a detailed analysis of each retailer. I knew each retailer intimately as a result. I knew what matter to the retail buyer as a person as well as a retail category buyer in addition to the retailer go-to-market strategy, their pricing and promotion strategy, etc. We talked as friends and I was able to earn their trust as a result.

That simple lesson has paid huge dividends. Demonstrate that you know how to help them achieve their objectives on a consistent basis. Put their needs first - always.

Action Steps todo This Week

Write one sentence:

“Our brand helps [Retailer] win by…”

Build your pitch around that one sentence.

Eliminate anything that doesn’t support that narrative.

Retailers don’t want pretty charts.

They want insights.

The Founder Mistake

Is Showing topline velocity without context.

The Retailer Lens

They want:

To know how the product compares in their store to the market

How your brand impacts overall category growth in their store and in the market

if your item indexes high and with premium households

if your item fills an assortment gap at their store or in their market

how it affects shopper loyalty, share of wallet, and basket size

The Better Way is to

Turn numbers into strategy.

Instead of:

“Our velocity is X.”

Try:

“Shoppers who buy our product spend 23% more in this category.”

Or:

“Our item converts mainstream shoppers into premium ones — this is where the category is headed.”

Action Steps todo This Week

Identify your top 2–3 insights using:

syndicated POS data

And shopper marketing data

Create a single slide titled:

“Here’s what the data says your shoppers want next.”

This alone differentiates you as a category leader, not just a brand.

Retailers reward brands that make their jobs easier.

The Founder Mistake

Brands show up to “get” shelf space.

The Better Way

You show up to give value:

They already know how the category is performing in their store. Provide insights they don’t have access to - insights on how your core customers shop the category and how are your shoppers uniquely qualified to help the retailer achieve their objectives. When they buy your brand, they also buy X, Y, and Z. Their market basket is X% higher than other brands in the category.

A great thing to showcase is how your ideal customer buys the things the retailer cares most about in their stores. This goes back to knowing their strategy and what matters most to them. For example, years ago I was able to gain exclusive distribution on a national brand by highlighting how customers who purchased our brand also purchased their produce, meat, and dairy. These were the things the retailers cared most about - where they drove the highest margins and largest basket growth. Conversely, the competitor’s shoppers were loyal to price and therefore would go to a different retailer if they found a better price.

This is what I mean by brands using deep discounts to commoditize their brand and the category effectively not providing any really loyalty to their shoppers to remain loyal to a specific retailer.

This positions you as a partner — not a vendor.

Action Steps todo This Week

Bring one unexpected insight to your next retailer conversation.

Bring one creative—but practical—merchandising solution.

Ask:

“What’s the biggest challenge you’re trying to solve in this category?”

That one question flips the entire dynamic.

Sell category growth, not your product.

Own your recommended placement argument.

Align with the retailer’s persona and strategy.

Use data the way category leaders do.

Show up as a strategic partner, not a vendor.

None of these require a big budget.

They require clarity, preparation, and knowing what retailers actually care about.

This is how small brands punch far above their weight class.

This is how you land more shelf space — and keep it.

This is how you extend your runway while growing sales sustainably.

Over the next several episodes in the New Item Essentials series, we’re going to dig deeper into:

evaluating brand health

maximizing assortment

building merchandising strategies that drive shopper loyalty

increasing market basket size

and mastering category management

If you haven’t already, download the New Item Essentials Guide in the show notes.

It includes placement visuals, checklists, and strategies big brands use — but small brands rarely see.

And as always:

Subscribe and follow the show

Connect with me on LinkedIn

Visit RetailSolved.com for the full list of episodes plus brand building resources

Share this episode with a founder who needs to hear it

In the next episode were going to talk about WHY TRADE SPEND FAILS (AND HOW TO FIX IT)

You don’t need to play the same game big brands play.

You just need to understand how the game works — and how to stack the odds in your favor.

I’m Dan Lohman, and this is the Bulletproof Your CPG Brand podcast.

Sign up to receive email updates

FREE Trade Promotion ROI Calculator:

Click Here To Maximize Sales And Profits

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.