Case Studies

1. Cemented legacy brand as category leader adding rocket fuel to their growth

2. Identified huge new growth opportunity for a gluten-free snack brand

More examples coming soon. Keep checking back!

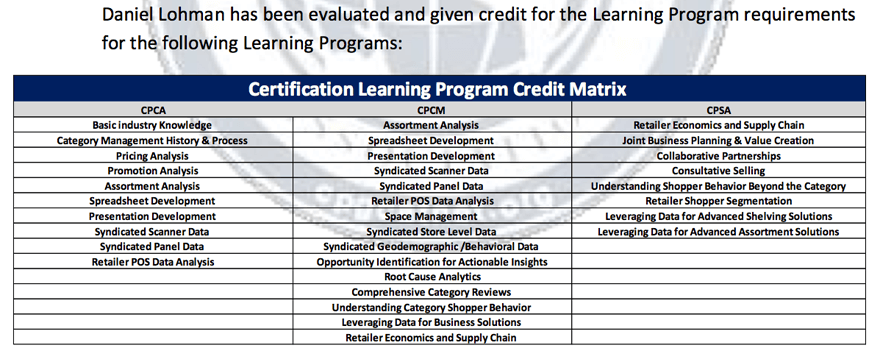

What my professional certificastion includes:

I am the first person certified at the highest level of category management proficency – Certified Professioinal Strategic Advisor (CPSA).

*All examples have been sterilized. The work I do is all custom and propriety. I find golden nuggets others overlook – my secret sauce.

Empowering Brands | Raising The Bar

Ever wish you just had a roadmap? Well, now you do!

Don’t miss out on all of these FREE RESOURCES (strategic downloadable guides, podcast episodes, list of questions you need to be asking, and know the answers to, the weekly newsletter, articles, and tips of the week. You will also receive access to quick and easy online courses that teach you how to get your brand on the shelf, expand distribution, understand what retailers REALLY want, and address your most pressing challenges and questions.

All tools that you can use, AT NO CHARGE TO YOU, to save you valuable time and money and grow your sales today!

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.