Unlock the Blueprint for Category Growth with effective merchandising strategies to enhance shopper experience and boost sales. Brands should provide planograms and data-backed insights to retailers for optimal product placement. A holistic approach to space management prioritizes the unique consumer and considers retailer goals and consumer shopping habits.

A picture is worth a thousand words. The first impression shoppers have of your brand is on a store shelf – make it a good one! An effective merchandising strategy can make it easier for shoppers to buy your products and add rocket fuel to your growth.

Listen where you get your podcast

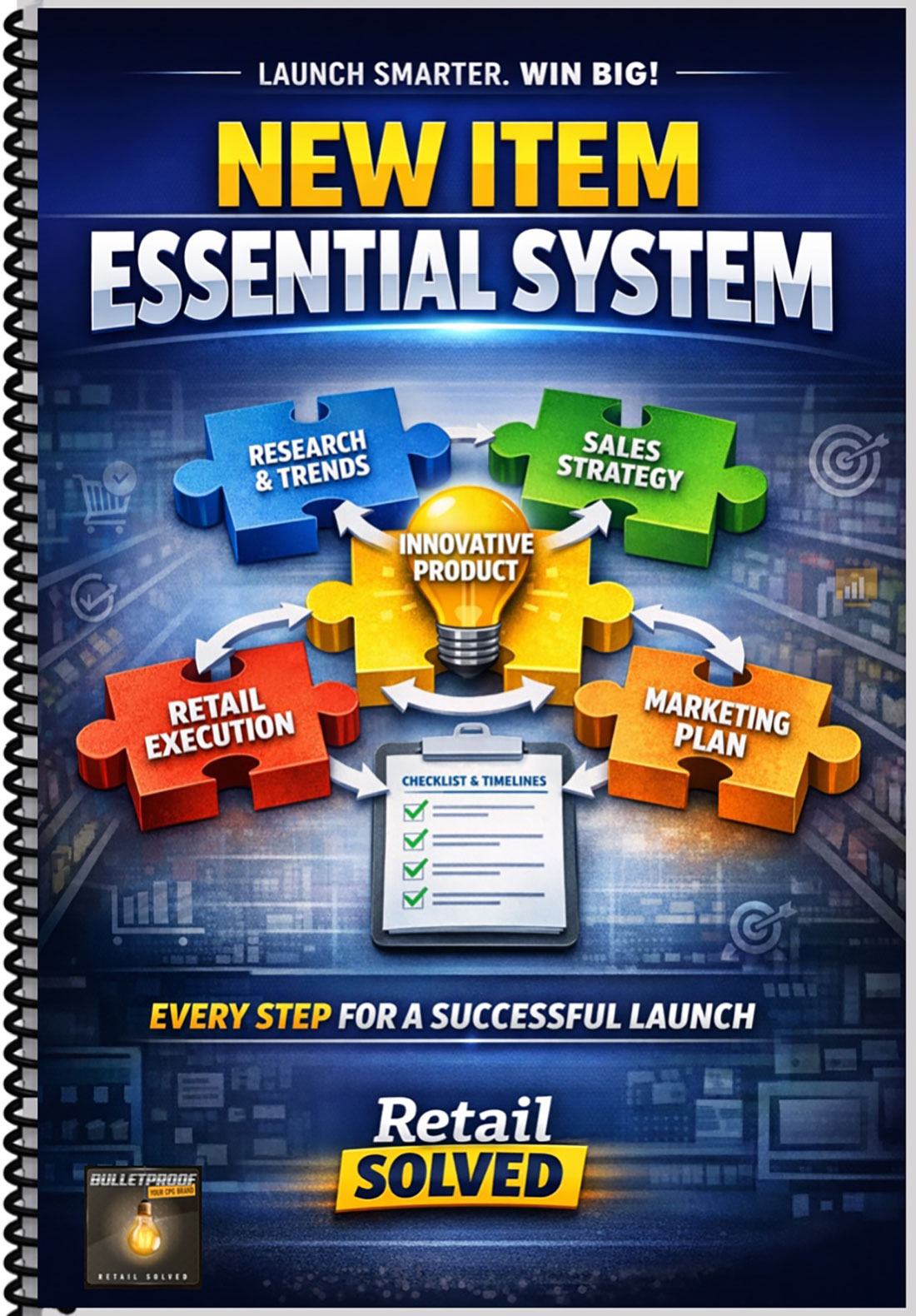

Important: Brand Secrets and Strategies has been rebranded to Retail Solved. Please swap all BrandSecretsandStrategies.com URL’s with RetailSolved.com. This is now the Bulletproof Your Brand podcast. Thank you for listening! BRAND SECRETS AND STRATEGIES PODCAST #106 Hello and thank you for joining us today. This is the Brand Secrets and Strategies Podcast #106 Welcome to the Brand Secrets and Strategies podcast where the focus is on empowering brands and raising the bar. I’m your host Dan Lohman. This weekly show is dedicated to getting your brand on the shelf and keeping it there. Get ready to learn actionable insights and strategic solutions to grow your brand and save you valuable time and money. LETS ROLL UP OUR SLEEVES AND GET STARTED! Welcome. To sell more grow beyond other brands in your category, then you need to use strategies that they overlook. This is going to be the focus of the solo podcast that you hear from me, over the next couple of months. I've had the privilege of working with and mentoring hundreds of brands in our industry. These series of podcasts are dedicated to answering some of the questions that they share with me. I surveyed the people who get my weekly newsletter, and they've validated the same bottlenecks. The focus of this podcast is how to land shelf space and win at retail. This is the blueprint that you need to follow to ensure category growth, and to get your products on more retailer shelves and into the hands of more shoppers. One of the biggest mistakes that brands make, literally all brands makes when they get into retail, is that they're so excited to gain distribution with a new retailer, they don't think about where their product belongs in the retailer's shelf. This is a huge mistake, and as I said, literally every brand makes it. Retailers cannot begin to be an expert in every category and every item they sell. They need your help and they need your guidance. It's to your advantage to help guide the retailer as to where your product belongs on their shelf. A lot of brands don't realize its schematic work is typically farmed out by the retailer to a third party vendor, typically a broker or someone else. They frequently decide where the products go on the shelf and how the category will be merchandised. Now while the retailer approves the schematic before they implement it, you need to know that your competition might be deciding where your product goes. The merchandising might also be decided by somebody who has no invested interest in the category. In either situation, you lose. Having someone that has no interest in the category or someone who doesn't know who your customer is or who the customer shops a category, or even worse yet, having someone who has a bias. decide where your product goes. This can derail your brand and even seal your fate. Dramatically limiting your ability to grow, to merchandise your product effectively or to maximize any promotions. Now. I've been doing this for a long time, so when I walk store shelves, these are the things that I look for. A couple of years ago, I was working with a young brand that just entered the category, the schematics were designed by their largest competitor. It was clear to me that the way that the schematic was merchandised was designed to set the small brand up for failure. Their brand was included in the section, as it should have been, so they were showing that they were "unbiased", but the reality was because of the way the product, the new brand was merchandised, it made it look like that brand was out of touch because their prices were so high compared to other brands in the section. In addition to that, it did not give the consumer that would buy the product, the opportunity to decide whether or not that product was worth a few pennies more. Instead, this product was placed next to a budget item, an item that attracts an entirely different customer that's only price sensitive. As a result, the product looked like it was extremely overpriced. This is one example of many, of something that you need to be paying attention to when you think about where your product goes on a retailer's shelf, this is extremely important. You need to be able to help guide the retailers where your product goes on the shelf so that you can maximize each and every selling opportunity to help grow your brand, and help the retailer get what they want; more sales in the category and more foot traffic because of the unique consumer that's searching for your brand. In episode 104, I shared a story that a listener shared with me about a brand who got distribution in a retailer, and there was so excited to get the distribution in the retailer that they didn't realize that the product had been placed in the wrong location and because of that it was extremely difficult to find it. The challenges, they're putting a lot of money in, a lot of effort into promoting the brand and yet when customers go into the store to look for it, they can't find it because it's in the wrong section. In addition to that, this is a huge loss for the retailer, because the retailer didn't get the benefit of the new traffic coming into their store. Also, the brand lost out because now they have to get the product re-merchandised. This is going to cost them a lot of money. I hear stories like this all the time. The bottom line is shoppers can't buy your products if they can't find them. I know this seems overly simplistic, but trust me, I see this all the time. Whether your product ends up on the bottom shelf or the top shelf or the wrong category all together. Or as in the example in episode 104, the product ended up in an entirely different department along way from where it should have been merchandised. This is something that you need to own yourself. You can't farm this out. Every brand, and I do mean every brand, needs a strategy as to where your products need to be merchandised. You need to leverage this strategy with everyone on your sellings team; whether it's the broker, the distributor, or anyone else. This is how you help the retailer understand what your customers are looking for to make your products easier to find. This is how you help the retail capitalize on that unique customer that comes into their store to buy your product. We've all heard the expression that a picture's worth a 1000 words, especially pictures that tell stories that resonate with us and leave a lasting impression. The first impression that most consumers have of your brand is on a retailer's shelf. Most shoppers search for their favorite brand first. Make sure your product stands out in a crowded shelf. On shelf merchandising is your first impression. You put a lot of money into your branding and your packaging, so make it easy for current and future shoppers to buy your product over the competition. Shelf merchandising needs to be consistent across every store and every retailer, especially at health food stores. Poor product placement and confusing merchandising are the single biggest problems most brands face. You worked hard to get your products onto the shelf, make it count. Identify the prime location for your brand and validate it with fact based insights. Retailers use planograms to map out where your product will be merchandised. Grocery stores are broken into categories as similar and complimentary products. An effective brand building strategy is to provide planograms or schematic recommendations to the retailer at every new item presentation. Schematic software can be expensive, but trust me, there are a lot of creative and low cost solutions available. Providing visual merchandising recommendations will make it easier for the retailer to say yes to your new items. I mentioned a moment ago that you need to support your recommendation; your shelving and merchandising recommendation, with fact based insights. A lot of people start out with can top line reports. While this is fine, this is not enough to differentiate you from other brands. You need to provide insights, actionable insights that are going to help the retailer understand why your brand needs to be in a specific location and in a specific category. I'm going to break it down as we go through the podcast. I believe that every opportunity that you have to get in front of a retailer should be used to educate the retailer about the category, and more importantly, about that unique consumer that buys products in the category; your consumer. I believe that space management should be included in every presentation. A picture's worth a 1000 words, and if you can illustrate to the retailer where you believe your products need to grow on their shelf, that helps guide them to make the best decision to make your products easier to shop for. These are some of the fundamental strategies I've used throughout my entire career. I'm classically trained in all things category management and space management, and at one time was considered to be proficient in Apollo and ProSpace. They were the leading schematic softwares of the time. In fact, I actually taught my peers and several retailers how to use the products, how to use the space management software, including at national retailers. Now, I don't share this to impress you. I share this to impress upon you, that this is a topic I know well, and that I know the power of being able to leverage these strategies to help the retailer, help guide the retailer to help sell your product. Traditional space management methodologies and strategies overlook what makes natural, natural. They tend to overlook that unique shopper that's looking for your product. So I'm going to recommend a new strategy, a holistic approach. A holistic approach is going to focus first on the consumer that buys the product, your unique product, as opposed to the generic consumer that shops a category. The shopper journey's changed, and this is one of the key things that we need to focus on. Consumers don't want to be sold. They want to buy the products that best meet their needs. So why does this matter? Because if you can do this effectively, you can increase distribution, preferential merchandising, it can help you with your trade spitting, it will maximize your promotions, help you take a leadership role in the category. And if you do this effectively, you can help convert occasional customers into loyal evangelists. So what do I mean by holistic approach? Retailers want insights, fact based insights. You need to be able to educate the retailer and highlight the specific problem that your brand solves. What makes your brand unique, and how does your brand bring new shoppers into the category? You need to look at the category from the consumer's perspective. Remember that consumers have virtually unlimited choices as to where they spend their hard earned money. It's important that you get this right. It's important that you help the retailer develop the right merchandising strategy that's going to keep their customers coming back again and again. So one of the first things you need to do is know your retail partner. No two retailers are alike. You need to understand what kind of consumer shops a store, and then once you understand what kind of consumer shops a store, then what are the retailers' goals for the category? Did they want to use the category to bring more traffic or new traffic into their store? Is the category going to help support occasional purchases for staples, for example, items that people buy on a regular basis. Is the category going to introduce shoppers to new products? Think of some of the different categories that you find in a traditional store and identify how your product fits in. What's unique about the consumer that buys your product, and then how you can leverage the merchandising for your product to help drive traffic into the store, into your category. I share this because their traditional approaches tend to take a cookie cutter approach to the way they build schematics. For example, most people rely on what the call the Pareto curve, the old 80-20 rule. The general strategy around this is that if you focus on the top selling items by first ranking all the items in descending order; from the top selling item all the way down to the lowest performing item, then you figure out the cumulative share of the category. What percentage shared is each item represent of that particular category. As you begin to add the share that each item represents and the category from beginning at the top, working your way down and you get down to 80% cumulus share the category. The item below 80% are typically ripe for being discontinued. While this strategy is a good starting place to identify potential items that can be discontinued to make room for new items, it's not always a perfect strategy. Let me give you a quick example. Several years ago while working for Kimberly Clark, we identified that the Kleenex pocket pack was something that needed to be in the category. We actually ended up putting it on the checkout stand and selling it as an impulse item. Now the point is this, if you use their traditional methodologies of using only the Pareto curve assess every item in the category, then the Kleenex pocket pack would have no reason for being. It falls well below in terms of its total sales volume delivered to the category. But, and this is important, we identified that having that product in the category, than the assortment, that was the key driver to invite consumers to drive traffic to the category itself; to the facial tissue category. So what we found out is that while their product fell below the regular threshold of products that you might consider discontinuing based solely on the Pareto curve, discontinuing would have been a huge mistake because it would have taken sales away from the entire category. I could think of a lot of similar examples across different categories. The most important thing to think about here is how does a consumer shop the category? And if you remove that product, your unique product from the category, how might that impact sales and other categories? For example, can you imagine a store that sells peanut butter but doesn't sell jelly? Or spaghetti but no spaghetti sauce, or perhaps regular cookies and they don't sell gluten free cookies, which means that they alienate that unique consumer that buys gluten free cookies, as well as all the other items that that consumer might buy. All the other gluten free items that aren't available in that store. Think about how your consumer shops a category and leverage this in your strategy. So this is what I mean by a lot of people using what I would call a cookie cutter approach to space management. You want to change that. You want to develop a schematic that personalizes the shopper experience around the shopper, to help guide the shopper, to make it easier for them to find the products that they want. It's rare to find a schematic that takes into account the personal shopping habits of the consumer that shops the category and that store. Let me give you a couple quick examples. If you go into a traditional store, the sugary cereals put at eye level for the kids riding in the buggies. If you go into the baking aisle, then you'll see pots and pans in one section, flour and sugar in another section, and then other ingredients that you would use in traditional baking, for example, cake mix, et cetera. The point is that there's a strategy for every category. You need to learn the strategy and try to understand what different retailers do to try to bring customers in the store, to try to make it easier. Now, the next question is what strategies work best for your customers? To be able to answer that question, you need to really understand who the customer is that buys your category. More importantly, who's the customer that shops your product? This is why I put together my turn key sales story strategies course, to help you understand exactly who the consumer that buys your product. You'd be surprised at what you learn if you take the course. Few brands can answer this effectively. So what do I mean by that? Most brands tend to commoditize the shopper that buys their category or buys their product. For example, female had a household, 2.3 kids, et cetera. Well, you need to do is go well beyond that. Is your consumer a vegan? Does your consumer by plant based products only. If that's true, then you need to merchandise the category around their special dietary needs. How active is your core shopper? Do they have a family? When they eat your product, how do they eat it? Do they share it with a friend? These are important things that you need to know so that as you're building your merchandising strategy, you can bake this into your strategy, so they can help the retailer, help guide the retailer to the most effective strategy that's gonna support the customer that buys your product, their customer. Another key consideration is that the consumer that buys your product probably buys a lot of similar products in other categories. For example, the shopper that buys organic produce is more likely to buy other organic products around the store. For example, organic bread, organic spread, and other organic products in other categories. This is true for also plant based, gluten-free, allergy free, et cetera. As you get to learn more about your unique shopper, you get to learn about their buying habits, and the key thing to remember is that the consumer that is health focused, the consumer that buys plant-based gluten free, organic, et cetera, has high standards. They want what they want and they're not going to buy cheaper products just because the price is lower. They want products that deliver value. If you are what you eat then what you eat matters, and these consumers understand that. So now as you begin to paint a picture about the customer that buys a product, now you need to identify how do they shop. A lot of retailers put budget products or private label products on eye level to make it easier for the customer to find it. The problem with this strategy is that it doesn't encourage customers to try a new product. It doesn't grow the category. What you need to recommend instead is putting the premium and super premium products at eye level, and then putting the budget products down at the bottom or at the high shelf. The point here is that you want to give the customers an opportunity to make the choices that are best for them. If you put the best mainstream product next to the organic product, for example, then the consumer can make the choice which is better for them. Chances are if they understand the value of that organic product, they'll probably choose that, so for a few more pennies at shelf, they know that they might be satiated longer. The example that I like to give is a bread example. If you buy the cheap generic bread, you're hungry almost before you finish eating it. If you buy the best mainstream bread, then you might be satiated for three or four hours. If however, you buy the organic bread, and again you believe that you are what you eat, and you know that that bread has everything your body needs to fuel it more effectively, then paying a few cents more at shelf might be cheaper in the long run because you'll be satiated longer. Again, these are some of the things you need to be thinking about as you put together your merchandising strategy. One of the concepts a lot of brands use is something called fair share. What they mean by that is that if you get 30% of the sales in the category, then you should have 30% of the shelf space, and while this is a good benchmark, this isn't always the best strategy in. What I mean by that is we need to focus more on what unique about the consumer that buys your product. At the end of the day, at the end of the shopping trip, is your consumer going to spend more than the other brand? If that's the case, then perhaps you need more shelf space. Do you have enough facings to make sure that you don't have out-of-stocks? This is another consideration brands need to make. When you get to know your retailer, your retailers going to have certain guidelines, like 1.5 cases per pack out. You want to make sure that your product has enough holding power in the shelf so that it has enough products so that you don't have out of stocks, and so that the retailer doesn't end up having to restock it several times throughout the week. This adds additional cost to the retailer, and you want to make it as easy as possible for them to be able to sell their products and not having to constantly be monitoring the category to make sure that there aren't out-of-stocks. Now that you've become an expert in the customer that shops the category and your customer that shops your specific brand, and these shopping habits of the customer in terms of what are the categories that they shop. You also become an expert on the retailer; what the retailer expectations are. You know what the retailer wants and needs from anyone else producing a schematic for them. Once you have all those together, you can start creating schematic recommendations to help guide the retailer. So how do you do that? When I was the grocery manager Price Club before it became Costco, I used to literally draw the schematics on a legal pad. I used to identify where other products, when I draw the shelves and identify what product, what skew, when in what's lot, et cetera. While it was very labor intensive, the benefit was I was able to measure the results from the old schematic to the new schematic I created, and be able to identify the change. I grew the freezer category by 252% within a couple months. More importantly, I was also able to give this schematic to the merchandisers that work for me, and they knew exactly where every product went. There wasn't guesswork. What would happened before is that people would put products wherever there was a hole, wherever there was an open space. The challenges is that the merchandising will constantly change. Now, obviously I'm talking about several years ago, but by having a schematic that everyone could follow, then it made it easier for them to stock the section. It also made it a lot easier to manage the inventory. We knew what the average sell through was and we could be able to easily count them out on product on the shelf and be able to identify when we needed to reorder that product. Now remember, this is quite a long time ago before we got sophisticated, like a lot of the retailers are today. The amount of time that I spent then paid off dividends, huge dividends later. When I started with Unilever as a sales rep calling on independent retailers schematic software was a new thing and very few people had access to it. I used to hand draw my schematics and leave it with the retailer, or more importantly, I would actually take a picture of the section after I finished merchandising it so the retailer had it as a guide. This made it easier for them to manage your inventory and it made it really easy for them when it came time to order new inventory. I mentioned earlier that there are several low cost solutions to be able to use a schematic with a retailer, and different in terms of how to leverage it and what presentations to use it in. How do you use it to educate the retailer, what presentations it should be included in and more importantly, how you can use it so that your brand gets merchandised consistently, every place a consumer looks for your products. If you'd like to learn more about this and how to leverage and retail, to gain sales, to help get your product on more retailer shelves, and into the hands of more shoppers, then I recommend you take my how to land shelf space and win at retail mini course. The strategies taught in this course are not taught in any incubator, business school seminar or any place else that I've ever seen in the natural channel. In fact, the strategies taught here are strategies that I don't even see the big brands using. If you're able to use these simple strategies to help the retailer, to help guide the retailer to sell more products, to make it easier for consumers to shop the store, this is how you stand out as a category leader. A category leader is any brand willing and able to step up and help guide the retailer with the strategies that are going to help them gain more sales and compete more effectively. To learn more about this mini course, go to brandsecretsandstrategies.com/landshelfspace. You can also get there by going to the courses tab on my website. In this mini course, you're going to learn how to guide the retailer to drive sales with your brand. How to differentiate your brand as the category leader. How to identify incremental merchandising and promotional opportunities. How to attract new shoppers and make it easier for your loyal shoppers to find your products. How to avoid being an ATM machine to retailers, brokers, distributors and agencies. You'll gain essential merchandising skills. Develop a simple, easy to follow strategy to ensure that your products are found on store shelves. You'll be able to control your destiny by guiding your retailers to optimize your product merchandising to drive shoppers in to stores. You'll save valuable time and money. You'll become a value added resource to your retail partners, and you'll gain a significant competitive advantage. I'll be certain to put a link to the podcast show notes and on this podcast page at brandsecretsandstrategies.com/session106. As always, thank you for listening and I look forward to seeing you in the next show. This episode's FREE downloadable guide New product innovation is the lifeblood of every brand. New products fuel sustainable growth, attracts new shoppers, and increases brand awareness. Know the critical steps to get your product on more retailer’s shelves and into the hands of more shoppers. CLICK HERE TO DOWNLOAD YOUR FREE STRATEGIC GUIDE: The Essential New Item Checklist - The Recipe For Success Thanks again for joining us today. Make sure to stop over at brandsecretsandstrategies.com for the show notes along with more great brand building articles and resources. Check out my free course Turnkey Sales Story Strategies, your roadmap to success. You can find that on my website or at TurnkeySalesStoryStrategies.com/growsales. Please subscribe to the podcast, leave a review, and recommend it to your friends and colleagues. Sign up today on my website so you don’t miss out on actionable insights and strategic solutions to grow your brand and save you valuable time and money. I appreciate all the positive feedback. Keep your suggestions coming. Until next time, this is Dan Lohman with Brand Secrets and Strategies where the focus is on empowering brands and raising the bar.

Enter your name and email address below and I'll send you periodic brand building advice, tips and strategies.

Sign up to receive email updates

FREE Trade Promotion ROI Calculator:

Click Here To Maximize Sales And Profits

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.