There is a seismic shift in natural. “Amazon is propelling everyone in the industry to up their game a lot faster & innovate to get better”. Natural brands and retailers need to compete at a higher level to remain relevant and grow shopper loyalty

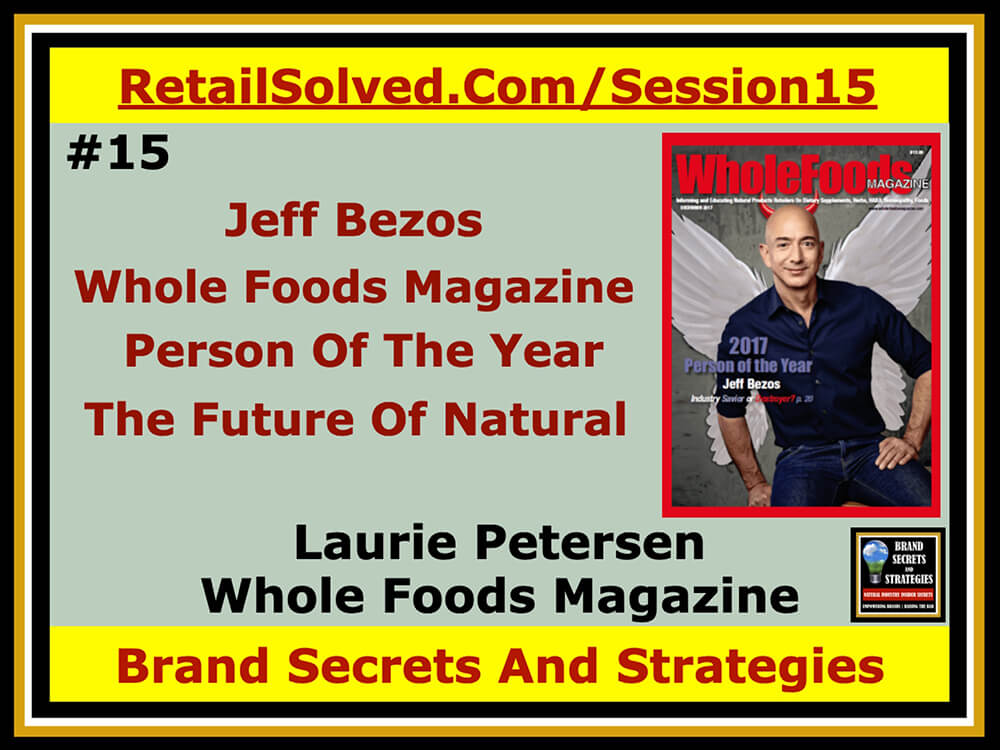

Welcome. Today I have a great story for you. Actually, it's really the story behind the story. It's the story behind the Whole Foods Magazine 2017 person of the year. It's amazon.com‘s Jeff Bezos. You can read the story on the Whole Foods Magazine website, and I'll include it at the end of this podcast, in the show notes, and on my website. It's a really interesting article, and I think you can get a lot from it.

I mentioned that this is the story behind the story in the article. Specifically, we're talking about how this is going to change the industry and the important impact that it's going to have on natural products as they grow and become more popular, more mainstream.

More importantly, we're also talking about the unique opportunity for independent retailers to capitalize on the Amazon acquisition of Whole Foods. This is an opportunity that natural retailers can use to differentiate themselves within the marketplace and stand out.

Download the show notes below

Click here to read the article on Whole Foods Magazine 2017 Person of the Year: Amazon.com’s Jeff Bezos

BRAND SECRETS AND STRATEGIES PODCAST #15 Hello and thank you for joining us today. This is the Brand Secrets and Strategies Podcast #15 Welcome to the Brand Secrets and Strategies podcast where the focus is on empowering brands and raising the bar. I’m your host Dan Lohman. This weekly show is dedicated to getting your brand on the shelf and keeping it there. Get ready to learn actionable insights and strategic solutions to grow your brand and save you valuable time and money. LETS ROLL UP OUR SLEEVES AND GET STARTED! Dan: Welcome. Today I have a great story for you. Actually, it's really the story behind the story. It's the story behind the Whole Foods Magazine 2017 person of the year. It's amazon.com's Jeff Bezos. You can read the story on the Whole Foods Magazine website, and I'll include it at the end of this podcast, in the show notes, and on my website. It's a really interesting article, and I think you can get a lot from it. I mentioned that this is the story behind the story in the article. Specifically, we're talking about how this is going to change the industry, and the important impact that it's going to have on natural products as they grow and become more popular, more mainstream. More importantly, we're also talking about the unique opportunity for independent retailers to capitalize on the Amazon acquisition of Whole Foods. This is an opportunity that natural retailers can use to differentiate themselves within the marketplace and stand out. Before we begin, I'd like to point out that Whole Foods Magazine is not Whole Foods Market. They're two independent organizations. In addition, Whole Foods Magazine publishes a lot of the articles that I write about the brand-building strategies that you hear on this podcast, and articles that you see on my website. Hello, Laurie. Thank you for joining me today. Before we get started, can you tell me first a little bit about yourself? Laurie: Sure, Dan. I'm the editor of Whole Foods Magazine, which serves the independent retailers as well as the natural products industry. We're based in south Plainfield, New Jersey. Dan: Great. Then, as far as your base, you said you support the independent retailers. Can you go into that a little bit deeper? What's an independent retailer? Why does this matter? What's unique about that group of retailers you represent, or you speak for, if you will, than say other retailers within both natural and mainstream? Laurie: Okay. Well, first, let me say that we do serve all natural retail, but our focus is on helping those who are, many of them, mom and pop shops and family-owned businesses, many of them who have been part of the natural foods revolution from the very beginning. There are roughly 7,000 across the country. These are people whose stores are really, I would say, pure in terms of having organic produce, organic products. It's not a mix of Cracker Jacks and kombucha. It's more mainstream natural and organic. The big difference that these folks offer apart from other retailers of organics, is product knowledge, and they can educate their customers about what's right for them in terms of new products, in terms of supplements, in terms of diet, and can take more time and really go deeper than someone who walks into Target, or Walmart, or Costco looking for organic food. Dan: Perfect. You know I talk a lot about this. In fact, that's what all of my content is about. Thank you. You've published a lot of my different articles. This is something we were talking also about at Expo East. Let me dig into this a little bit more to kind of frame it for the audience. It's natural organic products, which are responsible for the sustainable growth across every channel. It's that core, natural consumer that is responsible for driving sales not only in the independent natural retailers, but in mainstream retailers as well. It's that core, natural consumer that is better aligned with a natural retailer, because, as you stated, Laurie, it's that natural retailer that's able to help them, educate them, give them more information, more insights about the products, and help them solve their problems. It's a very important part of the, if you will, the natural food ecosystem. Without it, I would dare to say that we would probably have a lod of commoditized food. What I'm getting at is that when I listen to the "experts", all we hear about is price, price, price, as though that's the only driver for a consumer to come into a store. The consumers that you're talking about, the retailers that you support, are the retailers that want quality over price. With that said, one of the reasons I'm really excited about talking to you today is you just published an article, the 2017 person of the year, which is Amazon.com's Jeff Bezos. Which, by the way, first of all, I think is an extremely well-written article. Before we get into it, let me say one of the things that I liked about it most, Laurie, is it wasn't a one-size-fits-all type article. A lot of the commentary I've seen is it had been a hit job, or a praise job, and it has included only one side of the equation, where I think you did an amazing job of really framing the conversation so there's a little bit of takeaway in here for everyone. Laurie: Sure. Thank you so much. I'm glad you read it. We chose Jeff Bezos as our person of the year because, really, once Amazon purchased Whole Foods, it's the only thing the industry's been talking about. We get complaints from some of our readers, "What are you doing free advertising for Whole Foods?" But in reality, anything that Amazon touches, it changes, and it changes dramatically. We believe that the impact of Bezos, who, frankly, isn't even really that involved with the day-to-day of, certainly of the supermarket business, but his whole philosophy about business always being a startup, and about innovating for the customer, and customer obsession, and using data to drive decision making is very much the way that the Amazon company operates. Anyone who's in a senior level, he has a group called the S-Team, Steam, they are in ... They're full of the ethos of Jeff Bezos. When he came in, or when Amazon came in, they really were rescuing Whole Foods. John Mackey was very public about how frustrated he was with his investors, his agitated investors. And truthfully, Whole Foods solves a problem for Amazon in that they're trying to get better at the whole grocery, and online delivery, and fast delivery of food business. Also, for Whole Foods, obviously you've got a company with deep pockets that's not afraid to lose money, that's not afraid to experiment, and also has a technological advantage of being able to really bring Whole Foods into the modern age, and use that data to merchandise and get efficiencies in buying because Amazon is so large. But I think what's fascinating is that, in some regards, Amazon is now your mother's brand, in some regards, even though Amazon Prime is very popular with millennials, there are upstarts in the industry, and there are other independents, and there's certainly Walmart who purchased Jet who are all working really, really hard to get better. That, I think, is why we felt that, for better or worse, whether you love him or hate him, whether you think he's destroying the industries or saving them, you cannot say that anyone other than Jeff Bezos and Amazon were the significant elements and influencers of everyone in the food business in 2017. The question becomes, will they become a back-end distributor of technology for distribution and logistics? That's what some people think. Will they make organic and natural foods as inexpensive as regular food in a supermarket? Will they create a whole new ecosystem of growing? I mean, Amazon people were meeting with growers and producers prior to buying Whole Foods Market. When you're someone like that company and that person who really see no limits and no real boundaries, anything is possible, and that's really exciting. I mean, just this week they announced their second integration with an online food company, where you'd be able to get ingredients ordered through Amazon seamlessly through a recipe, which could compete with some of these meal kit companies who were offering convenience for people who don't necessarily want to figure it all out for themselves. He's got interests in indoor farming companies. There's a place called Plenty that just opened a 100,000-square-foot facility in Seattle to experiment with new ways of growing, and growing at scale. I think it's just, you know, for better or worse, truly a change-making time. The irony is that while Amazon may wind up commoditizing Whole Foods Market, and certainly it's changing the character by introducing electronics, and lockers, and all of that sort of thing. This is really a moment when independents can experience a renaissance, because there is an opportunity to work with the small entrepreneurial product creators who need to start somewhere to create demand and to create a market. If the small guys work with the small guys, they can have not only the education piece, but also a whole differentiated line of merchandise from whatever Whole Foods chooses to do. So it's going to be a really interesting time, not least of which is, you know, I talk a lot in the story about Amazon time, because anyone who's worked in a startup company knows that it just doesn't stop. It's relentless. And Amazon's been doing it for 20-some years, and Whole Foods culture is a little bit different than that. It's a little less aggressive. It's certainly focused more on the employee than on the customer, if you look at, historically, their pricing and that sort of thing. John Mackey has publicly stated in some forums that the integration has been challenging. But I notice in recent press releases from the company that he seems to be adopting Amazon-speak about delighting customers and that kind of thing. I'm sure there's a lot going on behind the scenes. Dan: You've shared a lot. Let me unpack some of that. First of all, everyone talks about lower prices for natural organic products. One of the challenges is that it's not necessarily that the products cost that much more. I mean, they do, but it's all the layers of cost that are required to get that product on the shelf. The idea that Amazon could streamline that and make it easier for a brand to get on a Whole Foods shelf, I think is really encouraging. Because I think the big picture here, as I think you well stated, is that if we can get natural products in the hands of more consumers, simple supply and demand, if we can increase the demand, increase the supply, prices are going to drop. So that I think is a really good thing, and certainly with Amazon's technology, I see a lot of opportunity there. Could you dig into that a little bit more? You did talk about it, but could you dig a little bit into that in terms of what are some of the other things that you see happening around that? Laurie: Around the technology, or around the- Dan: Yes. Laurie: Well, first of all, they drop prices for Thanksgiving. It's for Prime customers who are 90,000,000 or so people in the country, Amazon's sort of top-tier of customer, will now get to go to Whole Foods and have a scannable coupon that allows them to buy organic turkeys and a number of other goods at even lower prices than they're discounting them for the world at large. That scanned coupon is going to give Amazon all sorts of information about which Prime customers are coming in, which parts of the country, what hours are they shopping, what else are they buying, what's their total basket. These are things that are not revolutionary in terms of data gathering, it's just that a lot of places just don't have it in place to be able to collect this and act on it, and interpret it quickly. Amazon does. They're getting ready to launch their cashierless stores to take those a little bit more mainstream. Right now there's a pilot in Seattle where you go in and you scan, and then through a combination of artificial intelligence, and I think there's some virtual reality thrown in, I don't know, you just shop and buy and pay without any human intervention at all. But they're carefully tracking all of that activity to see, once again, what people buy, when they buy it, what happens if you put A against B, versus A next to C, and they use that to then make further decisions about merchandising, about inventory, about all kinds of things. I mean, their warehouses are, I think they're on their 8th generation of warehouse where they have gotten it down to a science of what is most efficiently packed next to what to get the maximum amount of bang for the square footage of a particular facility, which means that things are not organized by category in their warehouses. You might have a mop next to something else that's long and thin, like a baseball bat. It's like a space maximization. And it's all controlled through technology. That, I think, is just fascinating, and it's also the kind of skillset that can translate into the management of inventory for supermarkets and grocery. Obviously, you're talking a different kind of product because we're talking fresh versus shelf, but there are packaged goods in the organics industry as well. I think one thing Amazon really understands is the consumer who wants convenience, and they now will be able to let people pick things up at Whole Foods stores. They're partnering with retailers of all types, of all shapes and sizes, and they also are not being exclusive. I mean, they still have a partnership with Sprouts Farmers Market where they are testing delivery through Amazon Fresh using ordering from Sprouts. The potential impact is huge. The potential to fail is also there, but they're not a company that fails a lot. Dan: No, they don't. Actually, they have a very good reputation. A quote that you made in the article is, "Bezos' Amazon is propelling everyone in the industry to up their game a lot faster and innovate to get better." This is the core focus of why I do what I do. This is what we've been talking about all along. While we're learning about some of the innovative technologies that, as you mentioned, that they're bringing to bear on the industry, things that are really going to help people, let's go back to, you mentioned that the independent retailers are pure. The reason I go back to this is because I want to frame it in the sense that, like you said, there are pros and cons. One of the key things though is that independent retailers still have a very important place in this ecosystem. It's these independent retailers that still have a very unique niche and responsibility to help grow natural products throughout the channel. Can you speak to that a little bit more? Laurie: Sure. The important role that they play is, #1, they historically are the ones who really understand the products, who understand the latest science about the products, have teams, they have a staff who understands and can sell consultatively to the customer. They're friendly. They provide community. A lot of the independents offer programming, like a session with a dietician, yoga lessons, meditation, things that really impact the whole person, not just selling the product. I mean, the independent will also not sell you something that they don't think you should buy, even if you want to buy it, at least many of them won't. I think that they also tend to play a very significant economic role in their communities, where a natural food retailer may partner with a local fitness center, and a gym, and maybe a clothing store or something. They still are linchpin to the regions and the locations where they are. The people who run them, historically, have wanted to change the world by giving people the tools to live a healthier life, but not necessarily being obsessed with making money, like, earning a living, but not doing it motivated by economic gain so much as what they can give people. But in terms of their role and their importance in growing the industry, historically, the independents are where the new product producer was able to make a name, and get some customer feedback, and grow a reputation, and build, and then get big enough to be attractive to a larger entity. But the independents really can play to their local communities wants and needs. There's a question as to whether Whole Foods Market is really going to do that anymore. Historically, that's been their role, to focus on local providers and local producers. But as buying becomes centralized, and as things become more economically scaled, we'll see the impact that that has, which then makes it even better for the independent, who can be hyper-local in their focus. Dan: Absolutely. In fact, one of the things that I got out of your article and I heard at Expo is that, as you mentioned, that Whole Foods is going to centralized buying in Austin. I know of a lot of stories where retailers had gone to centralized buying instead of local buying, and that's had a profound effect on the industry and on small brands. One of the other challenges, you mentioned this in the article, too, is that they're not going to allow brokers in store, or demo people in store. So this creates a unique opportunity for the independent natural retailer to get a much larger voice within the industry. The point being, is that I don't go to Whole Foods for natural products. I go there for the experience and the education. I live in Denver, Colorado, close to Boulder, where we have a myriad of naturally-focused retailers, including one of the most progressive conventional retailers out there. So I can get natural products anywhere at just about any price. Again, I got to Whole Foods because of the experience. My concern though, is that as Whole Foods adopts traditional category management practices that tend to commoditize the consumer and the shopper, and what I mean by that is that everything is fairly similar. All natural consumers are similar to every other consumer, et cetera, and same with the products. They're going to potentially lose that connection with that core consumer that they built their brand on. Going back to that, you mentioned again that the small, natural independents are pure. The thing I want to emphasize here is that the opportunity for small, natural brands to develop relationships with those independent retailers to grow sales, and so if they have a partnership where they can work together to succeed, and grow, and compete more effectively against other stores, I think that's the opportunity for the small retailers going forward. Would you agree? Laurie: Absolutely. I've spoken with the folks at the Independent Natural Foods Association, and they are ... Food Retailers Association, excuse me, and they are very jazzed about the opportunity for their members, and are actually working on a whole messaging platform and marketing platform to roll out in 2018 to help support the independents. One of our columnists, Jay Jacobowitz, has suggested that there might be a little bit of humbleness, humility required on the part of some of the brands to come back to the independents who they've sort of forsaken for Whole Foods, but it's really the win-win for both the independents and the brands. Dan: I couldn't agree more. Let me dig into that a little bit more. One of the concerns I have with the Amazon-Whole Foods merger is, and that goes back to your previous conversation about a quote from Jeff Bezos where they need to up their game a lot faster and innovate to get better. The bar is set unfortunately, really low in natural. The challenge is that the brands that are stepping up to become category captains at Whole Foods are large, mainstream brands, not the little guys. Laurie: Correct. Dan: So the opportunity ... Yeah, and this is, I think, a huge, huge wake-up call. I've been setting this alarm for years that someday this would happen. The wake-up call is that the small, natural brands need to work harder to help the small retailers communicate the value, help them better connect with the consumer. Here's how I want to frame this. There is no retailer on this planet that could be an expert in every single category they sell. Savvy retailers rely upon natural brands, or the brands that work with serving them, but in this case, natural brands, to help them understand who are those unique core consumers. You mentioned Market Basket. A natural brand needs to understand who are their core consumers, when they buy their product, what other items do they buy. Then, help that retailer leverage those learnings to continue to grow sales in their store. I think this is the key that we need to be focused on here. I think it's great what Whole Foods is going to be able to do. But again, as you were saying about [inaudible 00:29:07], this creates a unique opportunity for natural brands to work more closely with natural retailers to keep this as a vibrant part of the ecosystem. Also, in addition to this, I want to highlight, you mentioned this, that the small natural brands that got their start on these shelves, they owe their legacy to their small retailers where they got their start. So it's critical that those brands go back to their legacy, where they got their start, and help new brands get on the shelves. Because the reality is, as mainstream brands are helping Whole Foods grow sales in their category, it's the small, innovative, disruptive brands that are going to get lost, and it's imperative that independent retailers capitalize on this because that's their unique selling proposition. That's their difference, if you will. That's what's going to keep consumers coming back into their store. Even if a small independent retailer has a Whole Foods down the street, this is how you still remain relevant within your market. Laurie: Right, because you'll have things that they don't have, and you'll have to come to your store to get. Dan: Exactly. In fact, a few years ago, you mentioned Walmart, Walmart did something several years ago where they eliminated all but the top two brands within every category in their private label, thinking that, well, this is going to help build their sales. What happened, for those of you who are not aware of this, is that their customer count dropped dramatically. This was a huge win for Target. They were quick to change their position and bring those brands back on the shelf, but a large retailer like that, it takes a long time. I hope that Whole Foods learns from that and is able to maintain that relationship with their core consumer. I read an article about a year or so ago about how Whole Foods lost their mojo. I think it's the fact that because they're paying attention more to Wall Street than Main Street. From my perspective, they're losing touch with that core consumer again, the one that they own their existence to, the one that got them started, the one that helped build them to the brand that they are today. With that said, what other thoughts do you have to help natural independent retailers remain relevant, compete effectively? And then, what should they do to help support the natural brands on their shelves, and the brands that left them to go to other retailers? How do they welcome them back? Laurie: How do they welcome them back? Dan: Yes. Laurie: It's an interesting question. The old ones that left them, or the new ones that are emerging from the old ones that left them? Dan: Well, it's a little bit of both. Think of it this way. When you walk into a store, it doesn't matter what store it is, if you don't see the products that you like, your perception automatically is that the store has a bad selection. If you walk in and you find a couple of items that you can get somewhere else at the same price, a couple of your favorite items, then your perception is that they have good prices, even if their prices are higher on other items. It's all about perception. So natural independent retailers need to, again, bring those legacy brands back to their shelves, or figure out a way to embrace them again, to encourage them to help support them, and help them support new brands coming on their shelf. What I was getting at is, what have you heard as you've talked to retailers and brands, are different strategies that they might be able to leverage that? Laurie: Well, we have something that we're officially offering at Whole Foods called Connect Me, which is a way for brands to connect with retailers and tell their story. I don't know. What ideas do you have for making it happen? Dan: I think the key thing is, and thank you for asking, I think the key thing, Laurie, is that natural brands have a unique opportunity to continue the messaging beyond the four corners of their package. I talked about this in Episode 6, and actually other episodes as well. Natural brands have a unique opportunity to help drive sales in any store they're in, because they're closer to their end consumer. They're closer to the consumer that they are trying to appeal to. And because they have that one-on-one relationship where they're talking with their consumers as opposed to a lot of big brands that talk at their consumers, they have a unique ability to leverage that relationship to drive sales within the natural store. That's the first thing. The second thing is, natural retailers need to work more closely with the natural brands. Natural brands need to help the natural retailers, because again, they're the experts in their categories. They also need to help the natural retailers understand what's going on in the category, not just the trends that you read about on a blogger's page, et cetera, but what's really driving sales, what's unique within that category, and what should the retailer be paying attention to. Then, going back to the local conversation, some of the things, the flavor of the market, et cetera, is another opportunity where natural brands and natural retailers could partner together to, again, make that retailer relevant and unique within the market that they serve. There are a lot of really great ideas. But long story short, the brands that want to play at the level that the Whole Foods brands are going to expect them to be at, need to be at that level. In other words, if you want to have an equal seat, natural brands, at the table as the General Mills, the Proctor&Gambles, the Kellogg's, et cetera of the world, you need to be at that level. Which means that you need to invest in the strategies that are going to support you so that you can play at that level. That doesn't mean you need to change who you are, or walk away from your beliefs. On the contrary. Your core values, that's your strength. What I mean by that is that those large brands don't understand your consumer as well as you do. Natural retailers, you need to leverage your relationship with these natural brands and make it easy to get on your shelf. You need to not charge them exorbitant fees for slotting and everything else. What I'm getting at is that the symbiotic relationship between an independent natural retailer and a natural brand is one that is so very, very important, because if that trend becomes really popular and ends up on a Whole Foods shelf, or even a Walmart shelf where someone is beginning it for the first time to learn about Omega-3s, or gluten-free, or something like that for the first time. Think back several years ago. To answer your question, it's that relationship that I think needs to be celebrated. It's that relationship that I think needs to be nurtured. This, again, is an opportunity for natural brands and independent retailers to remain relevant, to carve out their own voice, and to really take a stand in supporting local communities, organic farming, et cetera, as you mentioned. Do you have some other thoughts that you want to share, Laurie? Laurie: Well, I guess in many respects you'd say the brands will find themselves in the classic education role, or they can partner with retailers and educate consumers as well. But, yeah, they'll take that role more directly, rather than handing it off to someone else. I think the whole notion of the in-store demoing and all of that stuff changing at Whole Foods will be interesting to watch, because it may well be that the people who used to do it for outsource companies wind up coming inside to Whole Foods, and it doesn't really change a lot from the consumer's experience. There's certainly an opportunity to do more custom things with a small retailer, and things that have more bang, and have more impact, and have impact on the community, which I think is really an important element of the role of the independent natural products retailer. Dan: Exactly. In fact, I want to reiterate that I think this is the single biggest mistake that Whole Foods is making. No brokers, no demo, no brands being able to walk in and educate the retailer or the different stores on why their product is unique, what's going on in the market. What I'm getting at is a sales clerk cannot be expected to go out on their own with their own busy schedules and learn everything that they need to learn about a brand. The reality is, is that they're not going to have the opportunity to maybe learn about some of the unique technologies within a brand. Grass-fed, for example. A brand's ability to help a retailer understand what grass-fed is, for example, is the key. For Whole Foods to cut that out of their system, I think is a huge mistake. But, it's also a really big opportunity for natural independent retailers. Do you have anything else you wanted to add before we close up? Laurie: No, I guess, other than I really appreciate the opportunity to talk with you and enjoy our partnership, you know, trying to bring the category management sensibility and profitability, sensibility into the coverage that we do at Whole Foods Magazine. So thank you. Dan: Well, thank you. I really appreciate that. As I say a lot of times within my podcasts, a lot of the articles that I write, retailers already know. The bigger retailers already know how your item ranks on the shelf. They don't need you to bring a report that says, "Look at me. I'm #3 on the shelf." They need insights. What we're talking about here, what we're talking about today with Laurie, is retailers need to know what are the insights, who's the consumer driving the sales in their category, what the new trends are, et cetera. Again, Laurie, thank you. I appreciate your time, and I look forward to our next conversation. Laurie: Okay, thank you, Daniel. Have a great Thanksgiving. Bye. Dan: Thanks. You too. I'd like to thank Laurie again for coming on today's show. You can learn a lot from Whole Foods Magazine. It's chocked full of great articles and insights to help natural brands and natural retailers compete more effectively in any economy. In today's show notes, I will include a link to the 2017 person of the year, Amazon's Jeff Bezos article that Laurie wrote: the focus of today's podcast. To help brands and retailers begin to understand and learn more about these strategic solutions, I'm including my strategic solutions to grow your brand. It's a comprehensive guide designed to help you compete more effectively on the shelf. You can text "Strategicsolutions" to 44222, or download it in today's show notes. Today's show notes can be found at BrandSecretsAndStrategies.com/Session15. Thank you again as always for listening. Remember, this show is about you and it's for you. If you like this show, please go to iTunes and leave a review and subscribe. I look forward to seeing you in the next episode. This episode's FREE downloadable guide This short guide levels the playing field between small brands and their more sophisticated competitors. It highlights the advanced strategies the big brands use called Category Management - what retailers want. CLICK HERE TO DOWNLOAD YOUR FREE STRATEGIC GUIDE: Strategic Solutions To Grow Your Brand Thanks again for joining us today. Make sure to stop over at brandsecretsandstrategies.com for the show notes along with more great brand building articles and resources. Please subscribe to the podcast, leave a review, and recommend it to your friends and colleagues. Sign up today on my website so you don’t miss out on actionable insights and strategic solutions to grow your brand and save you valuable time and money. I appreciate all the positive feedback. Keep your suggestions coming. Until next time, this is Dan Lohman with Brand Secrets and Strategies where the focus is on empowering brands and raising the bar. Enter your name and email address below and I'll send you periodic updates about the podcast. Sign up to receive email updates

Listen where you get your podcast

Like what you’ve heard? Please leave a review on iTunes

FREE Trade Promotion ROI Calculator:

Click Here To Maximize Sales And Profits

Free brand-building resources to help you grow and scale

Turnkey Sales Story Strategies FREE ON-DEMAND COURSE

Why Most Brands Fail – The Roadmap To Sales Success FREE ON-DEMAND COURSE

Essential In-Store Customers First Marketing Strategies FREE ON-DEMAND COURSE

How To Drive Profits With Sustainable Packaging FREE ON-DEMAND COURSE

The Retail Game – What You Need To Know With Bob Burke FREE ON-DEMAND COURSE

Sales Success Begins With A Solid Business Plan FREE ON-DEMAND COURSE

How To Turn Your OnLine Data Into Explosive Sales Growth FREE ON-DEMAND COURSE

2016 Category Management Handbook Page 20 & 21

Want A Retail Math Cheat Sheet?

Each of us needs to perform basic retail math calculations but it’s not always possible to remember every formula, especially if you don’t use them on a regular basis. Here’s a quick cheat sheet with some of the most important formulas you need to know.

Empowering Brands | Raising The Bar

Ever wish you just had a roadmap? Well, now you do!

Don’t miss out on all of these FREE RESOURCES (strategic downloadable guides, podcast episodes, list of questions you need to be asking, and know the answers to, the weekly newsletter, articles, and tips of the week. You will also receive access to quick and easy online courses that teach you how to get your brand on the shelf, expand distribution, understand what retailers REALLY want, and address your most pressing challenges and questions.

All tools that you can use, AT NO CHARGE TO YOU, to save you valuable time and money and grow your sales today!

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.