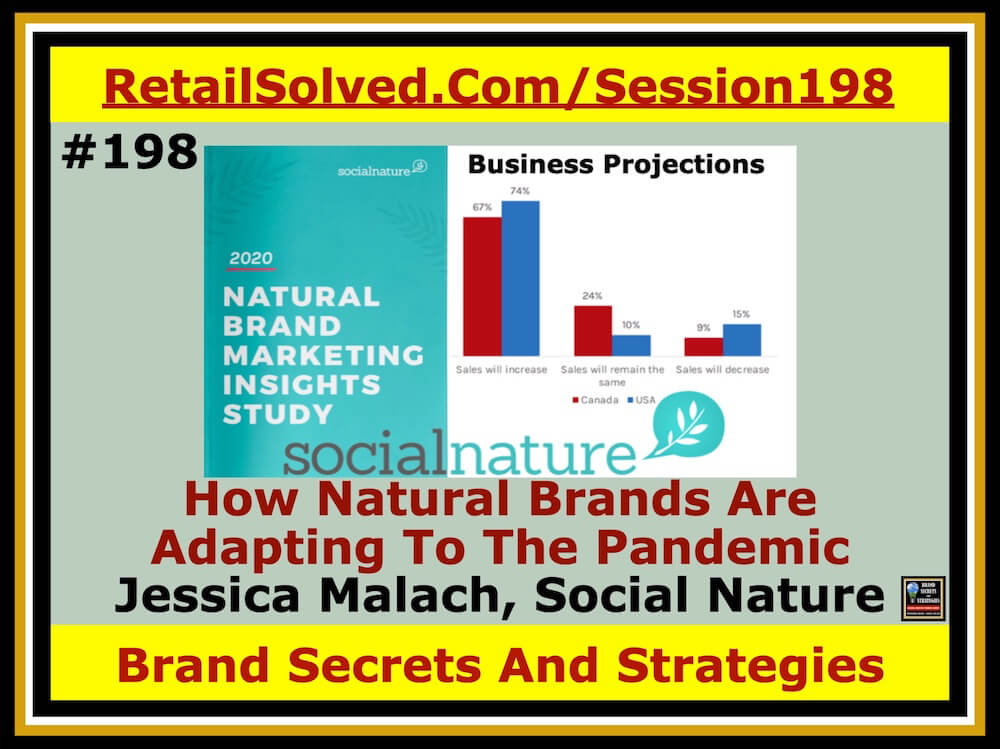

BRAND SECRETS AND STRATEGIES PODCAST #198 Hello and thank you for joining us today. This is the Brand Secrets and Strategies Podcast #198 Welcome to the Brand Secrets and Strategies podcast where the focus is on empowering brands and raising the bar. I’m your host Dan Lohman. This weekly show is dedicated to getting your brand on the shelf and keeping it there. Get ready to learn actionable insights and strategic solutions to grow your brand and save you valuable time and money. LETS ROLL UP OUR SLEEVES AND GET STARTED! Dan: Welcome. I've got a question for you. How are natural CPG leaders adapting to the new retail environment? Have you ever stopped to think about how COVID is affecting all of your customers, how they're affecting the retailers, how customers shop at the retailers, think about all the complexities of this? Well, unfortunately, a lot of the insights that you're hearing in the industry are really generic in terms of who the customer is. In other words, everyone's all lumped together or commoditized, as you've heard me say, what's unique about this podcast episode, as we're going to talk about your customer, understanding what unique about your customer, your customer that understands the value of your product. That's going to differentiate your brand, but more importantly, how's coven impacted the way that your customers shop and buy your products. And what are the products are they buying with? It has the pandemic that made it more difficult for them to find and buy your products. Dan: There are a lot of great insights that you're going to hear in this podcast episode, Jessica and the entire social nature team did an amazing job of identifying actionable insights that you can use today to leverage the strength of your brand and help retailers appreciate how you're working hard to help them drive sales in their stores as always thank you for listening. I appreciate you for being here. I always include one easy to download quick to digest strategy at the end of every podcast episode, to help you grow and scale your brand today, I'm going to tell you a little bit about it right now. I'm excited to let you know that I've got a brand new guide to help you grow and scale your brand. It's my trade-marketing optimization checklist. Trade-marketing represents about 25% of your total sales. And yet 70 to 90% of those dollars are wasted or ineffective. Dan: This free download is going to help you identify the things that you need to be focused on to maximize each and every one of your trade dollars each and every one of your promotional dollars. I'll tell you more about it at the end of the podcast episode. Remember this podcast is about you and it's for you. Do me a favor, help me raise the bar natural and share it with any brand that you know, that wants to grow sustainable sales. Now here's Jessica was social in nature, and this is a library recording that we did on a free webinar that I offered just recently. Dan: Hey everybody, thank you for showing up. Thank you for being here. Really appreciate it. I mean, the reason we're doing this, is about you and that's for you and we're trying to provide real value to you. And of course, it's free. So do us a favor and help share this. So we'll get to that more in a minute. So what are we here for? Well, how are natural CBG leaders adapting to the new retail environment? I want to start by thanking all of the groups that are partnering with me on this webinar series, partnering with us. So plant-based solutions ECRN RangeMe fellowship at the supermarket guru, promo mash, whole foods market, their produce moms, green circle, capital partners, a food business success, Bricktown group, summit sales consultants, they're brand new. So, okay. Uh, the big orange C-suite network, C-suite radio, and forest brands. Dan: And then of course, more importantly, you're here, uh, social nature. So thanks. And so, um, actually go to the next slide. So the reason I started this is when Expo was, was canceled. I leaned in and I decided the best way that I can help brands and retailers is by helping you with strategy, help bring strategies to you, to help you grow and scale your brand. So let us know what keeps you up at night and let us know what are the things that you, the questions that you have, and let us know. And we'll try to get those in either in the podcast, the YouTube channel or just on my website or in this webinar series. And on that note, I do have a podcast, brand secrets and strategies. You'll see some of this content on there, and then some of it, of course also be on the YouTube channel. Dan: So go there. Uh, there's a wealth of information. So do me a favor, help us raise the bar in the industry by sharing it with other people. And then I mentioned this weekly webinar series where we're going strong. This is number 14. So next week I'm going to share the presentation that I was supposed to give to the Canadian organic trade association and Anaheim, California expo West. So how to get your brand on store shelves and into the hands of sharps. What's cool about that is talking about the Canadian and the organic shopper Canadian in the US organic shopper. And what's the differences and their similarities between that shopper and other shoppers, as well as you'll hear today. And then the week after that, we're talking about a creative strategy to explode yourselves during the pandemic. And that's going to be really cool because we're going to teach you some strategies that you can leverage to get a leg up on your competition. Dan: So, uh, before I introduce Jessica, let me kind of frame our conversation around today. If you listen to the podcast, if you listen to this stuff I've been talking about all these years last several years, I'm all about how to leverage actionable insights with your retail partners and your customers. In other words, how do you communicate the value of your product to them? More importantly, how do you stand out on a crowded shelf? And what I'm getting at is that it doesn't take a lot of talent to press the print button on a computer and say, here's a can topline report and some generic insights. In fact, there are a lot of things in the industry that you've been seeing. I'm sure where the insights are somewhat generic. What unique about social nature brings is that these insights are from our community. In other words, these are your customers. Dan: And what's important about that is that your customers have a better understanding of what this industry is about. A what's important to them. Your customers are less price-sensitive, and they're going to go out of their way to find quality products that meet their needs. So take notes, because these are the kinds of insights that you need to bake into your selling story. You need to bake into your presentation. So that, excuse me, so that, uh, customers can, and retailers, et cetera, can better understand what unique about the customer that you're driving into a store. And as you go through my content, this is one of the fundamental things I teach is how to leverage that at shelf to get incremental distribution, incremental displays, reduce your trade spending, et cetera. So with that, I'm going to stop sharing my screen. Jessica, thank you for being here. Can you start by telling us a little bit about yourself and then I'll let you start sharing. Jessica: Awesome. So thank you so much for having me, Dan and everybody. Uh, thank you for attending today. I'm Jessica Malick and I've worked in the CPG natural industry since 2004 with a focus on helping natural brands grow, uh, through coaching, on marketing strategy in the United States and Canada. So I work with early-stage companies all the way through to companies, a hundred million-plus in revenue through the acquisition. And, uh, I grew up shopping in health stores, uh, with my mom taking me there. So I'm very passionate about this industry and about, uh, helping consumers find ways, uh, to, to have their health and lifestyle goals achieved through Nashville products. So really happy to be here today and share these insights with you. Thank you so much for joining the webinar. So we're going to be covering today, uh, insights on how our natural CPG leaders adapting to the new retail environment. Jessica: And I'm also going to be covering some consumer shopping trends and taking a look at what's driving online sales. Um, what are the top growing categories online? And then how can you take advantage of these growth friends? And we're going to be talking about some practical tips that you can apply to your business. If that's an area that you want to focus your growth on. And for those of you who aren't familiar with social nature, where essentially a natural product discovery platform, and we're a trusted place for consumers to be able to come onto the platform and to discover and gain access, to trying new national products and to have an opportunity as Dan had mentioned earlier, uh, to share their voice and what they want to see in the marketplace. And so brands, uh, leverage us as essentially a go-to-market solution where they can launch new products, where they can find ways to convert new customers through the data that's created on the platform and the feedback from consumers. Jessica: And then also to be able to capture product reviews and to drive targeted trial at retail online and offline. And so over the last five years, we've worked with over 500 natural brands and crossed out all and cross categories in the United States and Canada to support them on building that consumer demand and retail impact. And our company was founded by Emily Krebs, and she's very passionate about the natural product industry and helping brands grow. And she's been doing that for over 10 years. Did it give you a sense of what are we going to cover today? I would structure this into a couple of different parts. So the first piece is that we're going to, um, look at what are the overall levels of business confidence and what is the projected impact on revenue within this new and change in environment. We're also gonna take a look at how our leaders responding. Jessica: What's their competitive strategy to this change, and then starting to understand what shifts might be happening in marketing strategy and what shifts you may want to focus on as well. And then the last piece is that we're going to cover the online shopping habits that I mentioned, and we have done a study of 2,500 consumers they're in both countries. So once we go through that, we'll have a Q and a at the end and Dan will be moderating that discussion. So as we go throughout this presentation, feel free to put your questions into the chat. Uh, this is being recorded as well and will be shared out. So you will have access to that. So if you want to take notes, you're welcome to, if not, you can just sit back and absorb the information. Jessica: So to give you a sense of what the study was. Uh, we had 205, uh, senior leaders from CPG manufacturers in the United States and Canada participate in our study. And we're very grateful for that. And people's valuable time because without that, we would not be able to surface these insights and have this conversation today. And we had a strong representation between the United States and Canada quite an equal split there. And then we think about, well, what was the size of the companies that participated? It was a very broad range from early-stage companies with less than a million in revenue, all the way through to companies, a hundred million-plus. And the average size was about 18 million. Um, in terms of representation from categories over 44 categories were represented from companies selling in maybe one or two, as well as companies that are competing across multiple categories. Jessica: And overall people spent 22 minutes, uh, filling out the survey and sharing their voice and their strategies. And once again, I must say, thank you so much to everybody. So what are the levels of confidence right now in the market? What are people thinking? How are they responding? What we wanted to do first was understand what are some of the topics, sternal factors that have been impacting business right now? And we found five key themes across the board. Uh, the number one, uh, challenge has been in the supply chain. So a lot of people have dealt with delays. They've had issues with procurement, with international, uh, delivery, as well as fill rates at retailers. So that has been, a challenge and access to financing. Cash flow has also been, uh, difficult, uh, for some companies that are just growing so quickly. If they've been in an essential, [inaudible] making sure have the working captive to stay on top of that growth, uh, to companies that were not essential and instead end getting it more and not having the sales that they projected. Jessica: So that's, that has been difficult. Um, and employee retention and keeping them safe has also been a challenge as companies want to adapt their protocol, particularly those that have been manufacturing their own products and making sure that those protocols are quickly in place so that there is a confidence that the staff will be safe and that the products will be safe. Um, the final two trends that we're going to focus on today are what are the changes in consumer behavior? So a lot of people have commented that they're, you know, people are changing now, but what does the future look like? And how can I focus my business to get ahead of this? Um, and so that's been an area of impact. And then, of course, the retail environment, um, a lot of people have mentioned that you know, their needless scenes have been delayed, uh, in-store marketing programs have been on hold. Jessica: There are no more in-store demos. You know, it's a lot of change happening. And so what do I do to navigate this change? And despite all of this, uh, the overall confidence in the company's ability to adapt to change quickly is quite high. So on a scale of one to five, the average score in both countries was four. So people are feeling relatively confident and also around how resilient is my brand in the marketplace. That was 3.9. There was a little bit of a distinction between larger brands and smaller brands around that with smaller brands being a little bit less confident. And then the area of opportunity for more confidence would be in, uh, what are people's needs right now. So wanting to better understand the consumer mindset. And we're going to be talking about ways to do that in today's presentation. Jessica: So what are the projections over the next six months as the good news is that the outlook is mostly positive. So pretty close to 70% of companies in both countries are projecting an increase, and there's a little bit more volatility in the US market with more companies they're projecting some decreases. So how does this vary by category? Did we see any distinctions across the category is a personal care beverage, food, and supplements? And overall, again, the outlook is positive with 70% plus projecting not increased. So what will people's, uh, competitive strategies be? So we know that when we're in times of rapid change, we have to rethink how do we go-to-market and there are opportunities to reflect on that and how will you show up? And sometimes people will put their foot on the gas, so double down and go harder. Uh, other times people might hold, they might wait and see, and then other times people might cut back. Jessica: And that really depends on the sort of where you're at in your journey as a company and the culture of your company. And so what we've found is that when it comes to competitive strategy, the majority of companies are going to be putting their foot on the gas and they aren't going to be going after expanding their market share. And so people will be doubling down. And what makes this particularly interesting, this question is that this was a single choice question. So it wasn't like you could rank and pick all of them. It was really what is your, your, your strategy. So that increasing market share is the core strategy, uh, followed by focusing on product innovation with 24% of companies, and really only 7% overall our plan to cut back and weather the storm a bit now was their variations by country. We do see quite a variation. Actually. We do see that Canada is much more aggressive in expanding market share right now with 65% compared to the U S. And I think that part of that is, is related to how COVID has been impacting consumers. In general. We know that in the US, there are real distinctions and differences across different States and different ways of handling not. And so I think that's part of what's causing some of this change. Jessica: So having said this, uh, what will come of the talk distribution focuses be in the next six months? So where are people going to be focusing their time? Recognizing there is volatility in the retail space. What we found is that people will continue to be focusing on brick and mortar at the national conventional level and with regional and specialty places. And that when the 9% is going to be also really doubling down on eCommerce on their own site. And it's interesting because last year, a social nature did a study on this. And back then, it was like only 12 to 15% of companies were focusing on building out Adidas, ski model. And so now we've seen that number double over the last year, which is, which is interesting to consider when we look at clicking Gluck and online grocery delivery, those were smaller. And I think that part of that is based on fact that a lot of retailers are still trying to figure out the logistics of these journals to optimize the margins in those areas, and to be able to have more speed with delivery rates and things like that. So, um, we're going to be sharing what the consumer perception is of these channels and where they want to shop, uh, shortly. And the second part of this presentation. Jessica: So how does, is there any variance by country and yeah, we do see a variance actually. So in the US, there's more of an equal focus on DTC and brick and mortar when you aggravate the brick and mortar data compared to Canada. Um, the reason for that I think is that hunted us still remains that the hind, the US in terms of their, their development and infrastructure in, in eCommerce, there's room for improvement. And I think that as the retail landscape adapts more quickly, we're going to start to see some focus, a change there. Jessica: Is there any variance by company size? Yes, uh, there is. So what we saw is that smaller companies are more focused online and larger, more focused on brick and mortar. Uh, this reflects growth strategy, right? Once you get into maybe two, five, 10,000 stores, you probably have a lot more sales volume coming from that. And so the smaller companies, um, are focusing online and the reason for some of this increased focus on the line that I invite somebody to consider. If you are an earlier stage company, is that building out your brand online can be a really cost-effective way to quickly validate new product concepts. You can get a lot more data if you've set up your eCommerce platform. Well, to start to understand, like what's driving the demand, and that can be an excellent way to really start to understand that, and then be able to scale into brick and mortar. So that's a strategy that we've seen a lot in social nature and a lot, I think we'll see more of a brand street to do that now. Jessica: So what are some of the shifts in marketing strategy, recognizing that there are some, some change is happening, what are people going to be doing with their marketing dollars? So what we've seen is that people will still be focusing on brick and mortar. Um, 48% will be doing that, and how they do that is going to have to change. Why, because in-store demos are mostly canceled and the ones that are coming back, uh, may or may not be that attractive to consumers. We know a lot of in-store promotions have been put on, on hold. And so there's going to be an opportunity, uh, to rethink, uh, what your shopper marketing programs look like. And I'm going to share some tips on that a few minutes. And then the other thing is, is that one-third of people have just said, you know, I'm just going to shift and decrease completely from that channel. So the question is where are they going to be shifting and decreasing? And we see it's going to be more online. That's not super surprising since people are wanting to build out some C models, a greater focus on digital marketing and around product development and innovation. Jessica: So we know that, uh, digital has been on the rise for quite a while. It's certainly not going to go anywhere. Right. And so what, what are some of the things that people are going to be doing to be more competitive in a changing digital environment? So if you had only $1, where would you spend it? And so what we found is that, uh, improving web functionality is the number one strategy that companies are going to be investing in bullet by increasing paid digital and social advertising, and then building out their own eCommerce channels. And when you look at the chart here, you can also see that in the middle, there are a couple of strategies around more online discounts and 30% will be going after reviews. Um, those two strategies are absolutely critical to compete and win online. And I'm going to be talking a lot more about that in the second half of this and ways that you can leverage those to build out your online sales. Jessica: There's another theme here as well, is that we saw in the beginning that where there's a little bit more opportunity for brands to kind of feel that connection and understand what consumers want right now and how they're changing. And so we asked them, you know, what type of data would you want? Like, how would you want to sort of improving what you're doing? And the majority of people are looking for feedback directly on their products, and over one half are exploring brand messaging changes. And so it'd be interesting just to hear from you sort of how you're approaching yet. Uh, some of the brands that I've talked to you have been looking at, uh, you know, exploring whether or not that they need to have more transparency of information, whether they need to have greater communications around quality assurance and things like that. Jessica: So it's interesting to kind of see how that shifts and actually in August social nature, we'll be doing another study on what do consumers want for brands and this, and this, this current environment, and starting to get a feel for what types of information people are going to be looking for to have more trust in the space. So that's coming up in August and we'll be looking forward to working hard together with Dan on that too. Um, so what are the big takeaways from all of this in terms of a channel and marketing strategy? The number one theme that I see here, um, is this notion of convergence of shopper and brand marketing. So the old days of the linear path to purchase and the traditional shopper marketing are basically gone, right? Um, the, the way of having siloed departments, where you have the brand team and the consumer team and the shopper trade team somewhere else, um, are not going to be as effective, uh, because of the disruption in traditional shopper marketing. Jessica: I think there's a huge opportunity now for companies to realign your resources. Maybe you only have one person in marketing even that's okay, how can I align what I'm doing on the consumer side to drive more impact in-store? And one of the things that I found helpful, I've done consulting work, uh, with, with many companies over the last several years and ways to integrate sales and marketing, or our trading consumer, and a couple of tips there might be, have shared KPIs, right? So when we have shared KPIs, we naturally have more alignment. We naturally start to seek ways to move the needle on the critical, uh, metrics there. And so that could be something for you to consider as you start to look for ways to make your dollars go further and to be more effective in your work. Um, the other piece not to be too repetitive here is how can you use digital marketing tactics to drive the in-store impact? Jessica: That's another trend that's going to continue to happen. And then related to that is how can I build direct relationships with consumers? So really starting to double down on what their needs are. Um, and where are the most impactful decision points are in that journey, not the linear journey, but they're all over the place, right? They're finding information from everywhere. There are so many different points of potential influence. How can you start to understand where the most impact is and how you can do that? And the other thing that I get very excited about it, and I'm going to have some tips about this shortly. Um, it's not just for brands that want to build their own eCommerce is as we see the changes in retail happen as Amazon and Walmart advertising platforms get more complicated, more expensive, and all of the shifts start to happen. If you can start to learn how to build that relationship with your consumer and cut through the noise and identify ways to drive advocacy, that can be a really effective way to scale a brand, particularly for companies that are smaller. Um, so we're going to talk a little bit more about that, uh, shortly. So I'm going to pause there for one sec, because I know that's a lot, um, and our next section, we're going to talk about how have consumers' habits and shopping preferences changed online. Jessica: So what we wanted to do, recognizing that the online space is an area that's really important for many of you, brand manufacturers have mentioned, that's an area of focus. Uh, we wanted to better understand, well, what does this look like from the consumer perspective and where consumers spending their time and how are they buying online and what are some things that you can consider to be successful? So we decided to do a study in the US and Canada. We have 2,500 consumers, 60% us, 40% Canadian. Um, and on average, people spent close to seven minutes completing our survey, and we focused on the household and decision-makers for this project. So we wanted to better understand, uh, how they're going to be showing up and how they're going to be spending their dollars. And so what was interesting about this group is that 63% are quite new to natural. Jessica: So they've only been buying natural at certain parts of the basket over the last five years. And so there's an opportunity to really start to build a relationship with these people they're active across general. So they are buying online. They are in conventional and natural and specialty on average, they're shopping at three and a half channels. Um, and they have kids 60% have, uh, children and they're active across several different areas and actively products to their friends and community. So what we saw is that, um, 79% in the US and 71% in Canada are already buying groceries, personal care, and household items. And when we think about the top channels, uh, Amazon prime is the top channel in both countries, followed by Walmart and into the U S uh, target is gaining traction there with 29% fine on that channel. And then Canada grand direct actually was almost the same as Walmart. Jessica: And so I think it's interesting to see, um, how these channels are starting to grow. And one of the things that can be helpful if you're new to getting set up on Amazon or Walmart, is there are specialist agencies out there, there are people that know how to navigate, these flatworms. They can be very confusing and cumbersome. And so I recommend that you know, before you spend a lot of time and money on this, uh, maybe connecting with somebody that has done a lot of this before can help you to search, optimize what you're doing. Uh, we just learned the other day, actually that with walmart.com in the US you have to have a minimum of 24 store product reviews for them to even bother listening to you. So there are certain nuances there, um, that can be useful to know it bats so that you don't lose time. Jessica: So having that review strategy release ahead of time, you know, as an example, uh, can be something that would be useful. So is this going to continue? Are people gonna keep buying a line or was this just a COVID thing that's actually happening? What people have said is that, um, they are going to continue to shop online and with our U us, uh, at least once a month and Canada close to once a month, and then 25% and 19% of shoppers at least once a week. So the frequency is continuing it's increasing. And so that is knowing that that frequency is there. Um, that can be a really good opportunity to kind of build out subscriptions like subscribing state models and things like that. Jessica: So what categories are most popular online? Uh, what we've seen is that people are, are buying, you know, shelf-stable, um, have your products online, personal care, and cleaning supplies are very much shot top categories and vitamins and supplements. Uh, both countries 60% are buying those online. So that's a big opportunity for the supplement companies, as well as beauty, um, across the board, we do see that US consumers are more active than Canadians. So are there any categories that people don't want to buy online? And the answer is yes, a lot of people still don't want to buy the products online. They prefer to pick it out themselves and meat and plant-based alternative sort of more perishable frozen items, um, are not as desirable. And part of that I think is due to, uh, opportunities for improvement and delivery. And so we may see that start to shift, uh, as people get more confident in those areas and less expense. Jessica: Um, the interesting thing here though, is that one in four people, 25% have said, look, I want to buy everything online. So that's, that's a pretty big segment and a great opportunity for you, uh, regardless of what category you're in. If you can figure out a distribution partner, that's going to be profitable with your shipping. So, okay. So let's pretend that I'm starting to set up a new site and I want to find, well, how do I get new consumers to start shopping on my site? Like, what is the things that I need to think about? So I could be successful. Um, the top five things that are really important for you to consider are the leveraging discounts. This it's an online wild West discount world, unfortunately. And so having a discount strategy place is important. Um, free products, Ryle reducing that barrier can be also an effective strategy. Jessica: Why, because people can touch and see the product. They might want to just try it for free, depending on what it is first. Um, and having reviews is critical, right? Having that social proof that other people enjoy this product helps to de-risk the purchase, um, and having a friend recommendation. So leveraging us, you'll you might recall a few minutes ago, I talked about the value of building direct relationships. If I can refer more people to you through my network, that's a really powerful way to have that direct search happening. The final ease is detailed product information. So we know like we're all in the health and wellness industry, and we know that health is personal and people more and more and more want to know, like, what is this product? Is it clean? Like what kind of ingredients do you have? Like where have you sourced them, all that kind of stuff? So having that transparency is a way to quickly draw up a trust that you need to drive the sales conversion. If they have to be looking all over the place for nutritional information, or it's not easy to understand, um, you're probably gonna lose some. So there's a lot of opportunities to consider, um, having good product information in a way that's digestible and nicely displayed. Jessica: So what supports retention? So once I've got them, how do I keep them similar tactics? Again, the reviews, discounts, detailed product info, um, and the, friend recommendations are another way to, is to keep driving more sales there. The other thing is, is when I'm thinking about like one shuttle versus another, uh, what's most important, and having that loyalty or having people shopping your channel, um, both countries Losha penis is so important now, uh, we know that Amazon prime has disrupted that and people are just not willing to pay a ton of money on shipping for items that are readily available in stores or easily available, um, online. Um, so that's really important to consider and then trust in the store and the brand. So they want to feel like, you know, they're, they're going to get the product that they want. The product itself is trustworthy and the U S speed is key. So we know a lot of, uh, particularly some cities and states, you can get groceries delivered in two hours, you know, so you need to be thinking about how can I have speed. That's really important. And then, then Canada site navigation is important as well. So a lot of Canadians are wanting to make sure that they can find what they're looking for. Canadian e-commerce could be improved, I think on many, many, many areas. So that's something too to keep in mind. Jessica: So for consumers who are not shopping online, why not what's stopping them. Why aren't you online? Uh, so there's 21%, 29% in, in Canada. Um, the first one is I just don't trust other people picking up my groceries. I like to do it myself. Uh, people like to be in the in-store experience. Um, and the other third piece skier is, and this particularly despite himself, uh, with the onset of COVID, uh, it's just, there's just not enough delivery slots. So people are, have to go to the store, they couldn't get a delivery. So those are sort of the main barriers, um, to online shopping. Jessica: So let's see what are the top takeaways? When we think about online shopping with consumers, uh, we know number one is going to continue, and there's an increased focus on health and wellness. Um, you can lower barriers to purchase, uh, by giving incentives such as discounts, low shipping costs, and making sure you're set up with good speedy delivery. And then the other thing is making sure that you've got your, your review strategy in place, um, and that you've got transparent and easy to understand product information. Um, the other thing that I think, um, but I've seen in my work is that there is an opportunity to better build relationships with people by understanding their goals. So like, what is the big picture? Like, is there a specific goal or health condition that they have? Is there a specific dietary preference that they have and how can I make the shopping experience more personalized to them so that when they come onto my site, let's say I sell a lot of products or I'm retail. Jessica: Uh, I don't have to click around 10 or 15 times to figure out which, which product is aligning with the ketogenic diet, or where are the low sugar snacks, where are the low sodium foods? Like? So the more we can start to understand what people want in the first place, and then be able to tag our products that way, that becomes a really eCommerce strategy, because people are able to get what they want quickly and you know, what they want to be based on what their behavior is. So then you can start to retarget them and really start to build Welty. And I wanted to show you guys, uh, just to give you an example. So, uh, we wanted to see a social nature. Um, you know, what are people's health goals right now? Like how have, has there been a change since last year? Uh, last year we did, uh, two studies in Canada and two national studies in the U S around us. Jessica: And we found that overall, uh, the blue bars are this year and overall, uh, is an increase across the board and increased focus on health and wellness. Um, and the top goals are losing weight. So I've had a lot of friends say like the coed 15 people have gained a bit of weight during this time. Uh, eating healthier is another top goal. Um, and so if you're a food brand, um, you know, a lot of people are starting to do more, are cooking more at home. They're experimenting more with recipes, ingredients, maybe they never tried before. So if you are in the food business, having a recipe, content strategy, getting people involved, maybe in social media, contests, and giveaways show what they need with your product, giving in use demonstrations around different ways to cook with this product. These can be cool ways to kind of touch base with people on eating healthier and that eat healthier, candy fun. Jessica: It doesn't have to be boring. There are lots of fun things that you can do. Um, the third was increasing exercise and fitness, and then we also see, uh, uh, reducing stress. So 48% of people, like one in two people have said, I really, I just want to reduce stress and people want to increase their energy levels as well. 47% of people want more energy and people want better sleep, 47%. So when we think about stress, energy sleep, um, if you are a supplement bread and you sell products in this category, this could be a really good opportunity for you to quickly build a relationship with people, um, by helping them to solve all these problems, because they're trying to find ways to do it. Um, and there are opportunities there for you to be part of that solution. And so the other piece that I would highlight here is that biggest shifts. Jessica: And when we talk about, okay, everybody's more focused on, on health and wellness, whereas the biggest shift, the biggest shift is on prevention of illness. So that's not really that surprising given that we happen in, a global pandemic. Uh, and so it's interesting to consider, like if you are in, in the, in the supplement business, um, depending on your, your category, you might want to invest in content around like proper prevention, ways to support, uh, immunity and things like that, because those are areas of concern for people. And those are areas that people are spending money on right now. Jessica: So before we head into the Q and a portion, I wanted to just kind of wrap up with four tips on ways to build direct relationships with consumers. And these are tips that I personally used, um, with early-stage companies and with large scale companies successfully. So I thought I would share these with you guys and love to hear, uh, after emphasis something that you've already started doing or what your experience has been. So the first one is to think about like consumer power marketing and what does that mean? So one of the ways to really scale a brand quickly, um, and to have, uh, resilience and longevity is to think about your early adopters as your tribe. So if you can really start to understand and build relationships with people in the beginning and help them tell your story, make it easy for them to share on social, get them involved, maybe they have swag and stuff like that. Jessica: Um, that could be a really, really good way to start to build a recommendation that we talked about. So I worked with Vega a few years ago just before they were sold for half a billion us on consumer marketing programs. And one of the things that Vega did very well, uh, early on in their, uh, evolution was they went to the consumer right away. They built the community right away. They provided educational information right away. They understood deeply what people's pain points were right away. And it was that understanding and that connection that really helped drive so much, uh, recommendations. Um, and so that's like a, I can't, I guess I'm very passionate about this stress enough, um, how valuable that can be. Jessica: The other piece is to think about, um, providing something exceptional. So if I'm going to be building out almost on my own site, um, I need to do something different because we've seen that people are on Amazon and Walmart, if you're just doing the same thing, what's the point in going to your site? People can get the same thing on that, and there's no point. So if you want to build that relationship directly, um, it's really good to be able to think about how you can do something unique on your team final. So can you get launched unique flavors first, uh, are there different perks, um, is there content, can you bring in a health expert to build community, um, or do you have such a unique, differentiated product that people can only get it on your site? And that can work really well with certain, um, highly differentiated categories. That can be an excellent opportunity. So just thinking about ways you can make people feel special, um, and build that repeat sale. Jessica: So tip number three is creating a customer-focused culture. So I love this, this tip and a story. Um, one of my colleagues, a woman named Jacqueline she's, um, a very, quite a well known San Francisco tech executive, and do a ton of turnaround work in her career. And one of the things she told me a story that she was brought in to help this company a turnaround. And she walked in and she saw right away that people didn't have much communication. Uh, people weren't really listening to customers. They didn't really understand why they were failing and she shut down the entire company for a week and she put everybody on the phone and she made everybody do customer service calls. And what was so cool about that is that after the end of the week, uh, the shift in empathy for some over the customer and starting to better understand the customer, because they were thinking about understanding the customer, uh, was, was increased. Jessica: And then there was more empathy across the teams and in particular for the customer service team. And so the end of this, the whole team wrote their plan about the cure. Some of the key actions we can take to enhance this and the changes. And that company turned around pretty quick because they shifted their mindset to be more customer focus. And it sounds like such a simple, easy thing customer first in actual execution that requires communication systems and ways of interacting with teammates. Um, that can be very, very, very effective. So if you are thinking that that's an interesting idea, then maybe you want to try that at your company or your next finding retreat or something, ask your company, your team. Like, how can I, how can we be more focused? Like where are the gaps? You know the internal and external final tip is to keep validating across the product life cycle. Jessica: So we want to make sure that we're, we're learning as we go. So people spend a lot of time and money usually on new product launches. So they want to make sure they nail it and then they walk away and sometimes forget that they need to keep listening. And when we forget to keep listening, what can happen is new people can, a new entrance can come in and take our space. Uh, changes might be happening that we're not aware of because we're not, we weren't listening. And so there can be really, uh, good opportunities to kind of build out your, your social listening and start to look for. Are there changes, like, are there differences in my existing versus new customers, um, and are there differences in regions? And so that could be a very important, uh, strategy, um, and that's would be not social nature specializes in, and yeah, it's a, it can be really, really, um, really helpful rich way to continue to grow and protect your space. Jessica: So just before heading into the Q and a, uh, related to the theme of listening and validating products across the life cycle, uh, social needs are, we're going to be opening up our platform. We've got half a million natural shoppers online to the inspiring natural products industry, to be able to submit your products, uh, to our platform and to be able to encapture data, the data that Dan was talking about earlier, um, around what is driving demand in my, my product. So is it like which attributes are most resonating, where people want to buy the product, even down to the zip code level? Um, and are there any segments, um, that would be good for me to go after, and this is something that we're doing, um, as a way to unify the industry and the spirit of collaboration, it doesn't cost anything to do this. So if you are interested in this, my email is at the bottom of that slide, Jessica at social nature doc. Um, and you can just reach out to me directly and I'll help you get set up. So thanks everybody for listening. Uh, I'm so happy to be here to share this with you, and let's open this up, uh, to the Q and a now. Dan: So, okay. Anyone have any questions, one answer, and while we're waiting for other people to type stuff in, I'll put some other information in here. And then of course, here's the information about how to get the deck. And then, of course, we're going to have more content coming out around this. So anyhow, thanks, Jessica. I appreciate your putting it out there. What a great presentation, super insights. And the point that I want to drive home is that this is your community. So in other words, instead of top talking to a generic customer, generic focus group, these are the people that understand the value of the products that you are delivering. So could not agree with you more about a lot of those great tips in terms of how you need to develop a robust relationship with your consumer. And one of the things I've been saying, and I'll get to the questions in a second is that you need to have a platform or a community of around building a community around your brand. Dan: And so not knowing that Penn, the pandemic was coming. The point being is that that community that you have that knows likes and trust, you can do so much to help you grow and scale, to do so much, to help you innovate and develop products that they want. And they'll give you the feedback. And the best part is some of the strategies that I teach in the podcast, the courses, et cetera, are strategies where you can actually get more bang for your buck with promotions. And more importantly, you can leverage that relationship that you have with those customers aren't shelf. So, anyhow, let's get to the first question. So Janice says, what are some of the ways brands can grow market share, Jessica: Especially in question. Um, one of the things that I think is really, really important as overall in the beginning is to think about, um, building a brand strategy from day one. So really thinking about like, what is my story? Um, what is my mission? Like, what do I stand for as a company and investing in branding and a strategy that will resonate with your target audience, so that people see you as someone that understands them and that the products are delivering match the brand promise? And the reason this is important is that what can happen is once you build this, it's really easy to halo your brand equity across other product lines. So as you start to expand, maybe you're adding a line extension, uh, you are trying to get into another category. Uh, people already recognize you. They already know who you are. So they're more likely to buy that product, um, compared to other companies that sometimes get stuck in not stuck, but like focus on the product marketing, like just feature and benefits stuff. Jessica: And people don't really even know who, who it is like on the path. They're like, I don't even know the company. It's just, you know, so that can be tough because if you're not doing that and you want to expand and you want to start to protect your space, particularly in tough times, you might be up against other category captains or people that have developed that brand equity. And so that can be really important. The other thing from a practical kind of standpoint is, um, kind of thinking about, um, your assortment and starting to, to consider hero products. So what we did at Vega is that we knew early on that the Vega one was going to be the flagship product for the company. And so we spent, um, most of our marketing dollars are pushy, not on a regular basis. So we didn't just kind of do like a, a promotion once or twice a year. Jessica: That product was being promoted all the time, always-on, always in front of the consumer. And so that became the hero product that drove a ton of revenue, which is great, uh, and started to, uh, build our market share. And then you can start to leverage again, um, that hero product into other line extensions. And so I've seen particularly, I see this a lot with, um, with supplement companies and sometimes they get a space where, you know, they've got 200 skews they're competing in 50, 60 different categories, subcategories, um, and just getting spread thin. And it's hard to build market share when you've got a small marketing team that's trying to do too much stuff. You just, you miss the big picture and it's a missed opportunity. So this all kind of maps back to really thinking about building that brand equity and building acquainted differentiation. So if you are in a commodified space, sets a price for, um, you may want to think about how can I use innovation as a way to get out of that bottle and to start to build an opportunity to take market share. Great answer. In Dan: Fact, on that note, uh, the communities, what is really going to help you most, and, and to your point, I'm glad you touched on that. A lot of big brands can throw tons of money at products and try to build that market share, and that's not sustainable for any brand, but the reality is that those are the brands that are struggling at shelf. And those dollars that they're throwing at the, at the customer are actually pulling dollars profit out of the category. So this is a unique opportunity I want to touch back on the point you made earlier, which I think is brilliant by getting to understand your customer. And by going back and understanding what their journey is, if you can make it easy for them to say yes, and evangelize your product, that's a win-win. So thank you for sharing that. So John says any cool innovation in sharp marketing. Jessica: Yeah. Yeah. That's a fun question. Um, most of the innovation that we've seen is kind of around this convergence of, um, uh, brand and shopper marketing tactics. So lots, I've seen people using social advertising and social contests and him regional. So leveraging a social and digital to drive in-store impact can be a really good strategy. So if you have a key account where you're wanting then doing social contests around, Hey, this new flavor is in whole foods right now in a store in your area, um, go in there and we'll, and talking about maybe a new flavor and leveraging social media to drive in a certain pack is really good. Um, the other innovations that I've seen are also working on local partnerships and raising awareness out of the store to drive people into stores. And then another one that's cool, depending on your relationships with retailers can be the concept of the treasure hunt. So looking for ways to drive, um, you know, short-run, a heavy push, and promotion and creating senses of urgency around this product only available at this time, our Commonwealth supplies last and pushing that really hard online kind of like the black Friday frenzy, but something different and more unique to you. Obviously, it could be another tactic that works really well. Dan: Right. Thanks. Okay. So Karen says, and I love this question. What are the ways to achieve personalization in digital marketing? Great question care. Jessica: Yeah. Karen, that's such a good question. Um, so it all comes down to data. Um, so what I mean by that is when we think about, um, building digital marketing and particularly building out personalization, the way we do that is we need to tell the system what type of product this is and where to show the product in the search, or to understand, uh, what people are searching for. So people can quickly see this. So, uh, having your products tagged properly in the first place is really important. And so what I mean by that is, um, if you know, and we all know that people are now much more nuanced than they ever have before. There are so many different types of dietary preferences like keto [inaudible] gluten-free increase in allergens is huge. Um, so being able to tag your products as they relate to those very specific goals, um, and if you have strong claims, turning them into filters that people can sort by, um, and also thinking about merchandising by health goals. Jessica: So if I'm a new user and I sign up to your site if you can understand, you know, Jessica's increased, uh, interested and increasing energy in gluten-free products and low sugar, let's say, um, then you are only want to show me, or you're going to want to start promoting to me products that helped me with my goals and preferences and the way to do that is to capture that data. Um, when I signed up in the first place, and then there are ways to then have like a storefront that's personalized to me, Dan might have a different set of needs, or, you know, Mary might have three kids, all of them have a different allergy problem. So she's looking for multiple types of products. So by using data to properly tag our products in the catalog, that's what it's going to are a personalized search. Jessica: Um, and that is also going to help you, um, better segment people and better understand, uh, not only like people on a personal level. Um, and I think the other trend that I would say in terms of personalization without getting too technical into machine learning and AI and all that, um, it's just like step back for a second and try to think if you can, um, listen to the whole person. So like, if we think about people are not just like numbers and they aren't just categories, there are people that have different types of goals, different problems. If you can try to understand that, um, you're going to have a lot more areas that you can help that person and a lot more opportunity, uh it's to basically sell more products that solve their problems. So thinking more holistically, what is the physical side? Um, et cetera. Dan: Great answer. In fact, let me go one step further in my world, we call it rich product attribution. Now use the caveat. None of the databases that you look at accurate accurately reflect the way your customers are buying products. This is critically important. Thank you for touching on the Jessica, because, and the reason this matters is you take the insights that Jessica just went over and you bake that into your selling story. Now, when you're looking at the data, spins, Nielsen, IRI, whoever else, those don't accurately reflect that product attributes. And they, even the ones that have some of it, they're not, they're not a hundred percent correct. So reach out to me if you want some creative strategies around that, but I'll give you an example of why this matters several years ago, did a project for MegaFood. And what I did is I created condition-specific segments. Dan: So we bucketed the customers into segments, their products into segments based upon the problem that they solve. And then I put all the cold and flu stuff back in Asia, et cetera, into that segment. And by doing that, it was a game-changer for them and help them explode sales. My point is, the more as Jessica was Sam, the more personalized your message is the more personalized your understanding of the customer is that is going to help you exponentially grow cells. And more importantly, by being able to leverage these strategies in the data, when we take that to when I've taken that to retailers, they go, man, this is unbelievable. I've never seen that before because they're not seeing what's really driving sales at shelf because everything is so commoditized. So a whole nother conversation I'd love to get into with that, uh, to, to go deeper into that. Uh, another question Kathy says, what do you think the future of brick and mortar retail is given the new environment? Jessica: That's such a good question. Um, I think what we, what we're going to see is that it's going to keep growing in terms of this, this Omnichannel approach. So I may have, I'm a retailer and I've got, you know, tons of investment in real estate and square footage yet. I might be, I'm expanding my online platform to have more people searching online and leveraging the power of digital technology to then drive more personalization as we were just talking in the previous question, uh, for that shopping experience. So, um, we're seeing that retailers are launching their own mobile apps. Now they have for a while, um, and looking for ways to better optimize the app experience. Most of them are actually have not been very good, but they're, they're trying and, and being able to leverage, um, again, technology so that the shopping experience is, is more valuable, that it's faster, that it's easier. Jessica: Um, and also the other trend, which is somewhat counter to this, but kind of interesting is we're, we're talking about saving people time. I worked talking about making it easier. Um, and that also, I think that we're going to see, um, brands, our retail invest in more experiential. So yes, we have social distance, you know, police right now. Um, I still think that there's an opportunity for greater ready, prepared foods for people who want to come in and do their work and have a coffee in the retail environment, or who want to have an opportunity, um, to learn more and connect to a community. So that's something that will continue. And then on the smaller health storage shot on the side, on the independent side, um, a lot of them are unfortunately going out of business because they haven't been able to adapt and they haven't been able to drop the price as the mainstream channels have. So I think another interesting opportunity to disrupt the space on smaller format stores is where we're going to see again, more ready, prepared foods, and also this notion of kind of a wellness center. So you might see smaller format stores with supplements that also have a can natural path or alternative practitioners onsite, moody bars to drive traffic every day and things like that Dan: On the note, um, value versus price. And so if you, the brands can help your retail partners understand the unique value that you offer to your consumer. I hate hearing stories about retailers going under, and that's how you future proof that store, how you help that's the route was the most popular webinar that I've, that I've done thus far was how to future proof your store in uncertain times. So I want to go back and check that I know we're coming at the top of the hour. Uh, anyone has any additional questions, please reach out to either myself or to Jessica you're. Both of our email addresses are in the chat. And, um, any other last-minute questions I want to respect your time. And so if we didn't get to it, um, uh, we'll reach out to you afterward. Thank you, everyone, so much for being here really appreciate it, Jessica. Dan: Thanks for the answers. You know, one of the things that I think is really relevant, that a lot of people don't realize is that if you have a robust digital strategy that can impact and influence your traditional brick and mortar strategy. In other words, you can leverage that to drive sales and a traditional store. Oh, and by the way, you could leverage that with the retailer to reduce slotting and some of the other fees because you're driving traffic on their store. So any I'll top of the hour, I appreciate it, Jessica. Thanks so much. Any last parting thoughts? Jessica: No, thank you, everybody. It's an honor to be here today and, uh, thank you very much. I look forward to continuing the conversation. Dan: Great. Thanks. Yeah. And reach out to us if you've got any additional questions and I'll do my best to get this, uh, the replay available. So, uh, thank you. Appreciate it. Jessica: Thank you. Dan: I want to thank Jessica and the entire social nature team for putting together this survey and sharing it with us on the podcast and on the webinar. What an invaluable resource obviously wants to put a Lake so you can download the actual slides on the podcast webpage and in the show notes, I'll also put a link to social natures. So you'll definitely want to go to the website to check it out. In addition to that, don't forget this week's free. Download my trade-marketing optimization checklist. I'll be certain to put a link to it in the podcast show notes and on the podcast webpage, this download is going to give you the foundational building blocks that you need to build a successful trademarking strategy on. You can learn more about it and get the links to social nature by going to brandsecretsandstrategies.com/session198. Thank you for listening. And I look forward to seeing you in the next episode, Social Nature socialnature.com Thanks again for joining us today. Make sure to stop over at brandsecretsandstrategies.com for the show notes along with more great brand building articles and resources. Check out my free course Turnkey Sales Story Strategies, your roadmap to success. You can find that on my website or at TurnkeySalesStoryStrategies.com/growsales. Please subscribe to the podcast, leave a review, and recommend it to your friends and colleagues. Sign up today on my website so you don’t miss out on actionable insights and strategic solutions to grow your brand and save you valuable time and money. I appreciate all the positive feedback. Keep your suggestions coming. Until next time, this is Dan Lohman with Brand Secrets and Strategies where the focus is on empowering brands and raising the bar. Enter your name and email address below and I'll send you periodic updates about the podcast. Sign up to receive email updates

Listen where you get your podcast

Like what you’ve heard? Please leave a review on iTunes

FREE Trade Promotion ROI Calculator:

Click Here To Maximize Sales And Profits

Free brand-building resources to help you grow and scale

Turnkey Sales Story Strategies FREE ON-DEMAND COURSE

Why Most Brands Fail – The Roadmap To Sales Success FREE ON-DEMAND COURSE

Essential In-Store Customers First Marketing Strategies FREE ON-DEMAND COURSE

How To Drive Profits With Sustainable Packaging FREE ON-DEMAND COURSE

The Retail Game – What You Need To Know With Bob Burke FREE ON-DEMAND COURSE

Sales Success Begins With A Solid Business Plan FREE ON-DEMAND COURSE

How To Turn Your OnLine Data Into Explosive Sales Growth FREE ON-DEMAND COURSE

2016 Category Management Handbook Page 20 & 21

Want Flawless Promotions?

Promotions are the lifeblood of your brand. They increase sales, introduce your amazing products to future customers and help drive shoppers into the category. Shoppers expect them and retailers demand them. Most promotions are expensive and most do little if anything to grow sustainable sales and therefore are ineffective. So, how do we change that? Start with Optimizing Your Trade Promotion ROI with this simple cheatsheet.

Empowering Brands | Raising The Bar

Ever wish you just had a roadmap? Well, now you do!

Don’t miss out on all of these FREE RESOURCES (strategic downloadable guides, podcast episodes, list of questions you need to be asking, and know the answers to, the weekly newsletter, articles, and tips of the week. You will also receive access to quick and easy online courses that teach you how to get your brand on the shelf, expand distribution, understand what retailers REALLY want, and address your most pressing challenges and questions.

All tools that you can use, AT NO CHARGE TO YOU, to save you valuable time and money and grow your sales today!

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.