Trade spend often fails for emerging CPG brands due to a lack of strategy, leading to excessive spending and reduced profitability. This episode explores the five main reasons for trade spend failure, including a lack of understanding of true costs, incomplete promotion agreements, and promoting the wrong SKUs. By implementing a fully loaded cost model, creating detailed promotion agreements, and focusing on promoting the right products, brands can turn trade spend into a strategic growth lever.

Promotions should drive trial and build awareness, not reward existing customers. To be effective, promotions should focus on SKUs that drive repeat purchases, increase basket size, and reflect core brand attributes. Measuring post-promotion retention is crucial to determine the success of promotions, as it indicates whether shoppers are becoming loyal customers.

Listen where you get your podcast

🎙 EPISODE 271 - WHY TRADE SPEND FAILS (AND HOW TO FIX IT) THE UNCOMFORTABLE TRUTH ABOUT TRADE SPEND THE STORY — THE MOMENT EVERYTHING CLICKED THE $16,000 sale and the → $12.31 CHECK WHAT TRADE SPEND REALLY IS (AND ISN’T) STRATEGY #1 — Trade Spend Fails Because Brands Don’t Know Their True Costs STRATEGY #2 —Trade Spend Fails Because Promotion Agreements Are Incomplete STRATEGY #3 — Trade Spend Fails Because Brands Promote the WRONG SKUs Action step This Week STRATEGY #4 — Trade Spend Fails Because Brands Don’t Measure Post-Promo Retention STRATEGY #5 — Trade Spend Fails Because Brands Don’t Forecast Properly The Fix RECAP — THE FIVE REASONS TRADE SPEND FAILS

Enter your name and email address below and I'll send you periodic brand building advice, tips and strategies.

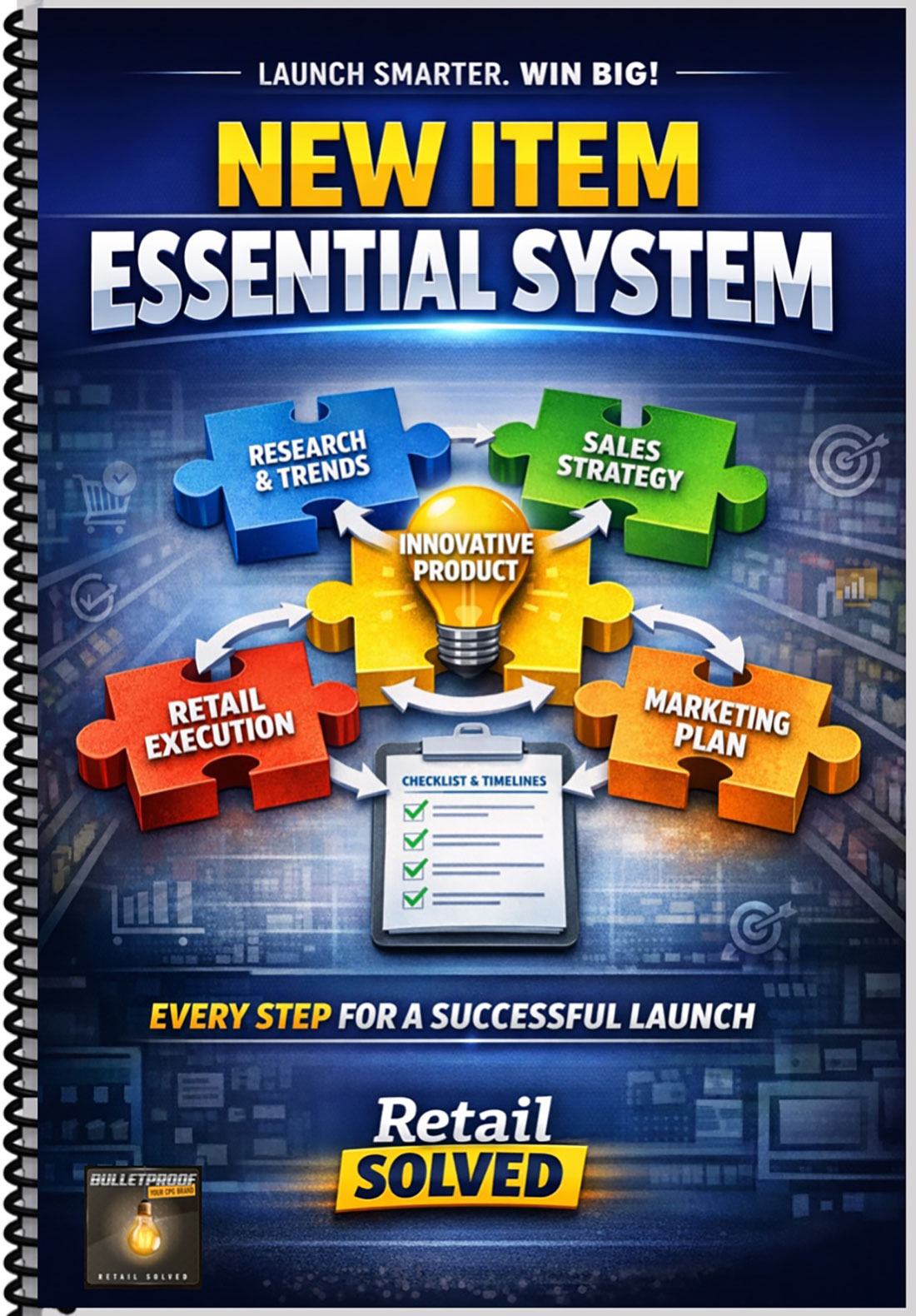

New Item Essentials Series

If you’re an emerging CPG brand, trade spend probably feels like the most confusing, frustrating line item in your entire P&L.

It feels like:

- a necessary evil

- a black box you never fully control

- a constant source of deductions

- a major cashflow risk

and something you’re always reacting to, never ahead of

And if you’re being honest, you’ve probably asked yourself questions like:

Why do promotions cost so much?

Why are my lifts smaller than expected?

Why do deductions keep showing up months later?

Why does it feel like I’m paying retailers and distributors… and still losing money?

You might even be wondering if trade spend is worth it at all.

Here’s the truth most people in this industry won’t say out loud:

Trade spend doesn’t fail because promotions are bad.

Trade spend fails because the strategy is missing.

And here’s the part that makes founders uncomfortable—but also explains a lot:

Many brands are spending more on promotions than they are actually earning.

You’re literally paying for the privilege of losing money.

That’s not because you’re careless.

It’s because nobody ever taught you how this system actually works.

Today, I’m going to change that.

In this episode, I’m going to walk you through:

- why trade spend fails so consistently

- the five foundational breakdowns I see across almost every brand

- how deductions quietly destroy runway

- how forecasting mistakes distort performance

- and how to turn trade spend into a disciplined, strategic growth lever

But before we get into the framework, I want to tell you about the moment that permanently changed how I think about trade spend—and why this topic became one of the core pillars of the New Item Essentials system.

Years ago, while working for Unilever, I was deep in the weeds chasing deductions.

At the time, I thought I was doing the right thing.

To me, deductions were a game.

The more I recovered, the more money I could put back into promotions.

The more promotions I could run, the more sales I could drive.

That logic probably sounds familiar.

Then one day, my boss pulled me aside and said something I wasn’t expecting:

“We pay you to sell—not to chase deductions.”

I pushed back. I explained how much money we were recovering.

He stopped me again and said:

“Those losses are already factored in. They’re part of the cost of doing business.”

That was my wake-up call.

Because in that moment, I realized something important:

Big brands understand trade spend as a system, not a series of events.

Around that same time, retailers began expanding trade fees aggressively:

- paid ad placements

- display fees

- slotting

- administrative charges

- billbacks

- promotional programs layered on top of promotions

From my perspective, that’s when many brands quietly became ATM machines for retailers.

And here’s the key insight:

Big brands could absorb it.

Small brands couldn’t.

That’s when I decided to learn everything I could about trade marketing—not just promotions, but incentives, economics, and behavior.

Because emerging brands don’t have the luxury of ignorance here.

Trade spend can quietly determine how long your brand survives.

I’ll let you in on a dirty little industry secret. Retailers don’t care about your sales lifts, they are going to make money from your promotion even if it is a colossal failure. Let that sink in for a while. The game is rigged and its rigged against you. Retailers earn a profit no matter how your promotion performs. More about this if future episodes.

If you listened to Episode 197, you’ll remember this story—but it’s worth repeating because it’s far more common than most founders realize.

A founder landed what looked like a great promotion.

Major retailer.

Strong timing.

Solid expectations.

They shipped $16,000 worth of product.

They waited for the lift.

They waited for the check.

When the check finally arrived, it was $12.31.

After:

- free fills

- off-invoice discounts

- billbacks

- admin fees

- Slotting

- spoilage

- unauthorized deductions

Their margin—and then some—was gone.

That founder didn’t have:

- a sales problem

- a category problem

- or even a velocity problem

They had a trade spend problem.

And sadly, that story isn’t rare.

It’s normal for brands that never built a trade strategy.

This episode exists so you never become the next $12.31 brand.

WHY TRADE SPEND MATTERS

Trade marketing is typically the largest item on your P&L. It includes everything required to get your brand into the hands of shoppers - everything.

Let’s clear up one of the biggest misconceptions in CPG.

Trade spend is not advertising.

Trade spend is retail negotiation.

It touches:

- pricing

- promotions

- deductions

- margin

- merchandising

- forecasting

- broker accountability

- contribution

- and ultimately your runway

For most brands, trade spend represents roughly 25% of gross sales.

And in many cases—especially in natural—70% or more is ineffective or wasted.

Not because founders are reckless.

Because the system is opaque.

Small improvements here compound faster than almost anything else in your business. That could be additional runway to grow and thrive.

And mistakes here get expensive quickly.

So let’s walk through the five reasons trade spend fails—and how to fix each one.

Promotions don’t fail because of velocity. They fail because of strategy.

If you can’t answer these three questions, your promotions are failing by default:

1. What does it cost to land one case on shelf—by SKU?

2. What is your true margin after trade spend—by item?

3. How much lift do you need just to break even—by promotion?

Most founders price based on:

- competitor pricing

- retailer pressure

- broker recommendations

- “industry norms”

- guesswork

Not real cost architecture.

Few brands understand SKU-level economics deeply enough to plan promotions confidently.

The Fix

You need a fully loaded cost model—by SKU.

That includes:

- true COGS (ingredients, packaging, yield differences) by item

- freight costs (especially for refrigerated and frozen items)

- distributor margins

- retailer margins

- slotting and fees

- promotion costs

- deductions. Where do the bulk of your deductions come from?

Only then can you build profitable pricing and trade plans.

Action steps for This Week

Model three scenarios per SKU:

1. baseline (no promotion) - you measure effectiveness against this

2. Temporary Price Reduction off shelf

3. Feature and Display

Do it by unit. Costs differer by item. Calculate the forecasted sales by item given each scenario.

Granularity changes everything. This will help you choose the right items to promote.

There is a free trade promotion calculator on my website compete with instructions. Input each of the different scenarios. Then compare that to the actuals. This is the only way you will learn what promotion levers drive sales for your brand. Promotion performance will differ by retailer.

This is one of the most preventable—and expensive—mistakes I see.

Vague, sloppy, or incomplete agreements = deductions you cannot dispute.

Missing:

- SKU-level details

- start/end dates

- frequency

- case counts

- display expectations

- back-stock requirements

- discount levels per item

- merchant-approved documentation

…all lead to:

- unforeseen costs

- incorrect bill-backs

- promotional leakage

- cashflow disruption

- and a distorted understanding of profitability

…leads to cashflow chaos.

Some retailers outsource deductions to firms paid on what they deduct. Yes, some firms actual earn a commission on what they deduct.

Incentives matter.

The Fix

Slow down and Treat every promotion agreement like a binding legal contract—because it is.

Action This Week

1. Add SKU-specific detail to every deal.

2. Include promotional goals AND merchandising expectations.

3. Recommend back-stock levels per store. Out-of-stocks are the quickest way to frustrate customers and embarrass your retail partner. Avoid them at all costs!

4. Store agreements digitally, by retailer and date.

I’ve seen brands cut deductions dramatically just by doing this. I’ve also used this strategy to negotiate lower fees with retailers - more on that in future episodes.

Most brands promote because the retailer expects you to run promotions. That should never be taken as a mandate. This is your brand. You should only promote what, when, and how it best supports your growth plans.

Most founders lack a trade marketing strategy so they promote just about everything with little thought or consideration to the possible impact of the promotion.

Now that you understand the costs of promoting your items, you can begin to develop a promotion strategy. What items make the most sense to promote. A couple of things to consider are the items availability. Never promote something if you are having a difficult time keeping the shelves full. You should also never promote large count packs or trial size items. They should have a different strategy.

The only reason you should promote an item is to drive trial and build awareness. That’s it - period. Few if any brands are that disciplined in their promotion strategy. Here’s why this matters. If you promoted your 5 count chocolate bar and I had planned to purchase it, then those trade dollars are not being used effectively. While I love the idea that I will be saving money, you already have me as a customer. I have creative more effective ways to reward existing customers that I’ll share in future episodes.

One of my favorite promotion horror stores is the mainstream cereal isle. Manufacturers jacked their prices really high so shoppers would only shop the aisle when they offered deep discounts. Sales were next to nothing in the absence of no promotion. They took away any incentive for customers to buy their products when they were not on sale.

Your promotion strategy should be driven by what makes the most sense for your brand. This includes how your items interact with each other.

You promote because:

👉 Your SKU drives profitable category growth AND long-term customer value.

The Founder Mistake

Promoting:

- your slowest SKU

- your lowest-margin SKU

- your “awareness” SKU

- your fringe SKU

- your innovation SKU

This dilutes everything.

The Fix

Promote SKUs that:

- drives repeat purchases

- build brand awareness

- increases basket size

- trades shoppers up

- reflects your core attributes

- delivers contribution

- grow incremental category dollars

- have strong gross margins

Promoting the wrong SKU dilutes everything.

Identify:

1. your highest basket-lift SKU

2. your highest contribution SKU

3. your most repeat-driven SKU

Build your next promo calendar around these three.

Build a promotion strategy for every item you sell. Sometimes, the best strategy is not to promote every SKU.

Retailers, brokers, and even many consultants evaluate promotions based on:

- lift

- units sold

- display execution

- redemption

But the ONLY metric that matters for you as a founder is:

👉 What percentage of shoppers buy again AFTER the promotion?

If you lose them immediately:

- your trade spend didn’t work

- your ROI is negative

- you bought velocity, not loyalty

Why This Happens

Brands rarely:

- measure new-to-brand vs returning shoppers

- evaluate promotional stickiness

- compare baseline before/after the promo

- track churn or repeat cycles

- understand why promos failed

The Fix

Measure retention like a subscription company. Use the free trade promotion tool on my website. Run different scenarios and then email them to you. Then after the promotion, input those details and email them to you. Now you have something to study and compare for the next time. This is the only way you can get better at running promotions - with trial and error. A promotion that works at one retailer might not work at another. Use the tool to take the guess work out of your promotion strategy. Once you identify the specific levers that drive sales after the promotion is over, you will then have a road map for future promotions.

Action Steps This Week

1. Look at your 4-week, 8-week, and 12-week post-promo baseline.

2. Calculate how many buyers stayed with the brand.

3. Compare your promos — which kept shoppers and which didn’t?

4. Stop running promos with low retention.

Retention is the difference between profit and loss.

Kill promotions that don’t retain. When you find something that works - rinse and repeat.

Out-of-stocks ruin great promotions — here’s how to prevent them.

This goes back to providing a recommended quantity for each store promoting. That then drives your inventory predictions.

Poor forecasting causes:

- out-of-stocks

- excess inventory

- wasted cash

- retailer frustration

- misleading performance data

And worst of all:

👉 Your promotional performance appears poor even when demand is strong.

The Founder Mistake

Guessing.

Relying on:

- averages

- historical lifts

- distributor input

- gut instinct

Build a simple, repeatable forecasting model that includes:

- distribution

- seasonality

- lift scenarios

- pricing impact

- competitor promos

- merchandising execution

- store-level variance

- back-stock requirements

Action Steps This Week

1. Build a forecast calculator for your top 3 promotions.

2. Include minimum, expected, and stretch scenarios.

3. Share the forecast with your broker AND your distributor.

Forecasting is leadership — and retailers reward it.

1. You don’t know your true costs — so you can’t price correctly.

2. Your promotion agreements are incomplete — causing deductions.

3. You promote the wrong SKUs — lowering ROI.

4. You don’t measure retention — confusing lift with loyalty.

5. You don’t forecast — causing out-of-stocks and wasted spend.

When you fix these, your trade spend goes from:

❌ a cash drain

❌ a source of anxiety

❌ a confusing variable cost

❌ a runaway budget

to:

✅ a predictable ROI engine

✅ a competitive advantage

✅ a reason retailers trust you

✅ a strategy that extends your runway

This is how small brands beat big brands — by being more disciplined, more strategic, and more consistent.

Promotions shouldn’t drain your business.

They should grow it—profitably and sustainably.

CLOSING — SIGNATURE LANDING

This was Episode 271 in the New Item Essentials series.

Next, we’ll dig into:

- operational excellence

- KPIs

- scorecards

- and how to make trade spend work for you at scale

Download the New Item Essentials Guide in the show notes — the trade spend visual maps directly to today’s episode.

And as always:

- subscribe and follow the show

- visit RetailSolved.com/podcast

- connect with me on LinkedIn

- And if trade spend feels like it’s controlling your business instead of supporting it, share this episode with a founder who needs to hear it.

- send me your biggest trade marketing question for future episodes

Promotions shouldn’t drain your business.

They should grow it — profitably and sustainably.

You now have the roadmap.

You don’t need more promotions.

You need better strategy.

I’m Dan Lohman, and this is the Bulletproof Your CPG Brand podcast.

Sign up to receive email updates

FREE Trade Promotion ROI Calculator:

Click Here To Maximize Sales And Profits

Image is the property of CMS4CPG LLC, distribution or reproduction is expressively prohibited.